Backed by a solid performance across all key metrics, the third-quarter results for Cerner Corporation (CERN) exceeded expectations, pushing shares up 5.1% to $74.29 on October 29.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The healthcare information technology, devices, and services provider’s adjusted earnings per share (EPS) increased 19% year-over-year to $0.86 per share, 4 cents higher than analyst estimates.

Similarly, revenue came in at $1.47 billion, a year-over-year increase of 7%, surpassing Street estimates of $1.45 billion.

Commenting on the results, Mark Erceg, Executive Vice President and CFO of Cerner, said, “The organizational transformation and productivity measures implemented earlier this year and additional on-going product focus and cost control initiatives are strengthening our business. A clear focus on cash generation is also having a positive impact as evidenced by a 32% increase in Free Cash Flow (non-GAAP) for the quarter.”

Based on the current business momentum, Cerner expects Q4 revenue to grow by upper mid-single digits compared to Q4 2020, and adjusted earnings to increase by 10%-13% year-over-year. (See Insiders’ Hot Stocks on TipRanks)

Meanwhile, revenue is expected to grow by 5% annually, for the full fiscal year 2021, and adjusted earnings are projected at around $3.30 per share. Additionally, CERN projects free cash flow (non-GAAP) of $950 million in FY21 and a total share buyback of up to $1.5 billion.

In response to Cerner’s financial performance, Barclays analyst Steven Valiquette maintained a Hold rating on the stock with a price target of $79, implying 6.3% upside potential to current levels.

Overall, the stock has a Moderate Buy consensus rating based on 5 Buys, 4 Holds, and 1 Sell. The average Cerner price target of $84.70 implies 14% upside potential to current levels. Shares have gained a modest 3.4% over the past year.

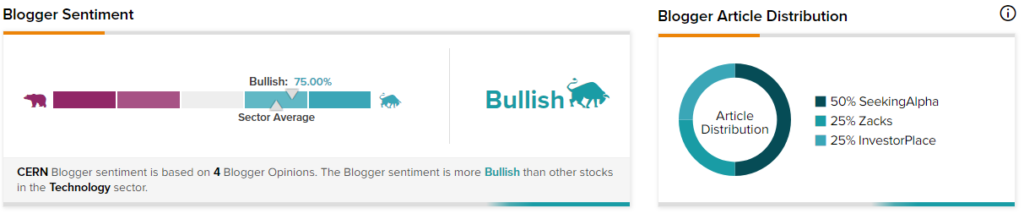

Additionally, TipRanks data shows that financial blogger opinions are 75% Bullish on CERN, compared to a sector average of 70%.

Related News:

Caterpillar Jumps 4% on Q3 Outperformance

Western Digital Plunges 10% After-Hours Despite Solid Q1 Beat

Yum! Brands Delivers Outstanding Q3 Results

5 Top Dividend Stocks for November 2021