Centene Corp. has entered into a merger agreement to buy Magellan Health in an all-cash deal valued at $2.2 billion, in a move to strengthen its whole health business and create a leading behavioral health platform. Centene shares rose 1.6%, while Magellan Health surged more than 12% in Monday’s midday trading session.

According to the agreement, the provider of government-sponsored and commercial health care programs has offered to pay $95 per share in cash, representing a 14.7% premium to Magellan’s close on Dec. 30. Centene (CNC) said it will primarily fund the cash portion of the acquisition through debt financing, as J.P. Morgan has provided $2.381 billion in bridge financing.

The transaction, which was unanimously approved by the Boards of Directors of both companies, has also received the green light from affiliates of Starboard Value LP, which own approximately 9.4% of Magellan’s (MGLN) outstanding shares of common stock.

Centene believes that the combined platform of the two companies, in which it will continue to invest, will allow for improved health outcomes and faster, diversified growth, as well as complementary offerings in behavioral health, specialty healthcare and pharmacy management.

As a result of the transaction, the health platforms will serve 41 million members. Magellan will bring 5.5 million new members on government-sponsored plans, 2 million pharmacy benefit members and 16 million medical pharmacy members. The company also provides specialty health services for 18 million third-party customer members in addition to Centene’s own members.

“There is a critical need for a fundamentally better approach to supporting people with complex, chronic conditions through better integration of physical and mental health care. This has become even more evident in light of the pandemic which has driven a dramatic rise in behavioral health needs,” said Centene CEO Michael F. Neidorff. “This acquisition accelerates our diversification strategy and enhances our ability to build next generation capabilities in our specialty care business by leveraging our scale and investments in technology.”

Following the closure of the deal, which is expected in the second half of 2021, Centene expects its debt-to-capital ratio to be in the low 40% range. The company said that it intends to use its strong earnings and cash flows to achieve its targeted debt-to-capital ratio in the upper 30% range within 12 to 18 months post transaction closure.

Following last month’s investor day meeting, Oppenheimer analyst Michael Wiederhorn reiterated a Buy rating on CNC with a $90 price target (50% upside potential)

“Like peers, Centene expects risk-coding (and margins) to be slightly impacted by its inability to perform in-home assessments, but this should disappear by 2022,” Wiederhorn wrote in a note to investors. “Overall, we believe Centene remains on track and the company’s stance related to its dominant Marketplace position will prove beneficial to shareholders.” (See CNC stock analysis on TipRanks)

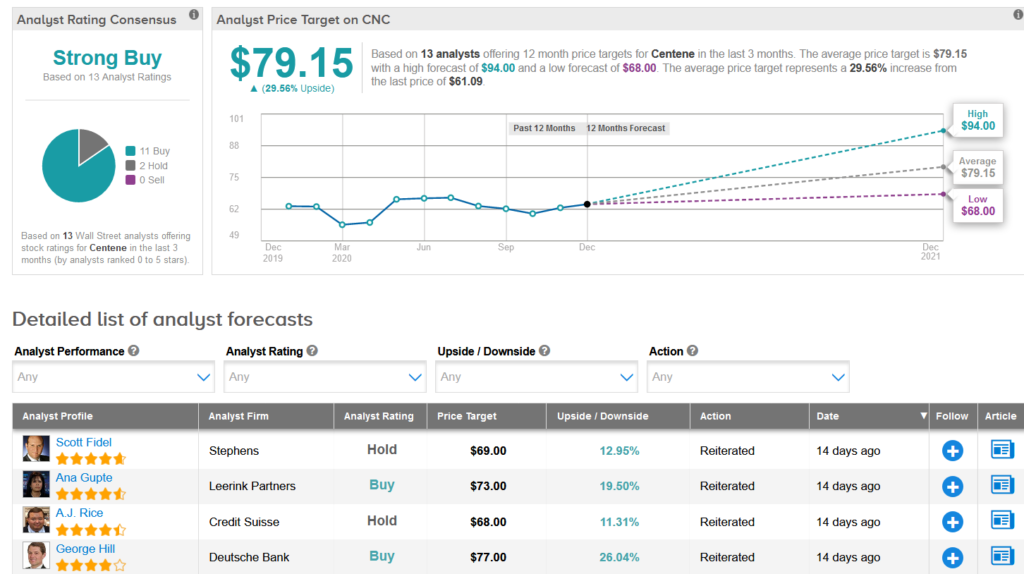

The rest of the Street has a bullish outlook on the stock with a Strong Buy analyst consensus based on 11 Buys versus 2 Holds. With shares down 4.5% over the past year, the average price target stands at $79.15 and implies upside potential of about 32% to current levels.

Related News:

Ferguson To Divest UK Plumbing Business For £308 million

Japan’s Kirin To Snap Up Stake In Indian Brewer For $30M – Report

Xpeng’s December Deliveries Surge, Reflect Robust EV Demand