Ace hedge fund manager Cathie Wood’s ARK Invest ETFs (exchange-traded funds) continue to amass e-commerce retailer Amazon.com’s (AMZN) shares. As per regulatory disclosure, ARK’s trades from October 21 show that Ark Autonomous Technology & Robotics ETF (ARKQ ETF) bought 20,883 additional shares of AMZN.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The latest purchase was worth $3.95 million, showing a consistently growing exposure to the American e-retailer. Despite the consistent purchases, AMZN takes the 21st spot in ARKQ’s portfolio, with a 1.54% representation.

Apart from Amazon, Wood’s ARKQ ETF also added 31,271 shares of BWX Technologies (BWXT), valued at $3.95 million. BWX is at the 34th spot in the ARKQ portfolio, representing 0.50%. Wood is also continuing to increase exposure to the biotechnology and healthcare sectors.

On the sell side, ARK ETFs sold 378,589 shares of Oklo Inc. (OKLO), with the largest sale price for yesterday, valued at $6.9 million. Meanwhile, ARK ETFs also made some smaller sale trades on October 21.

Is Amazon a Good Stock to Buy Right Now?

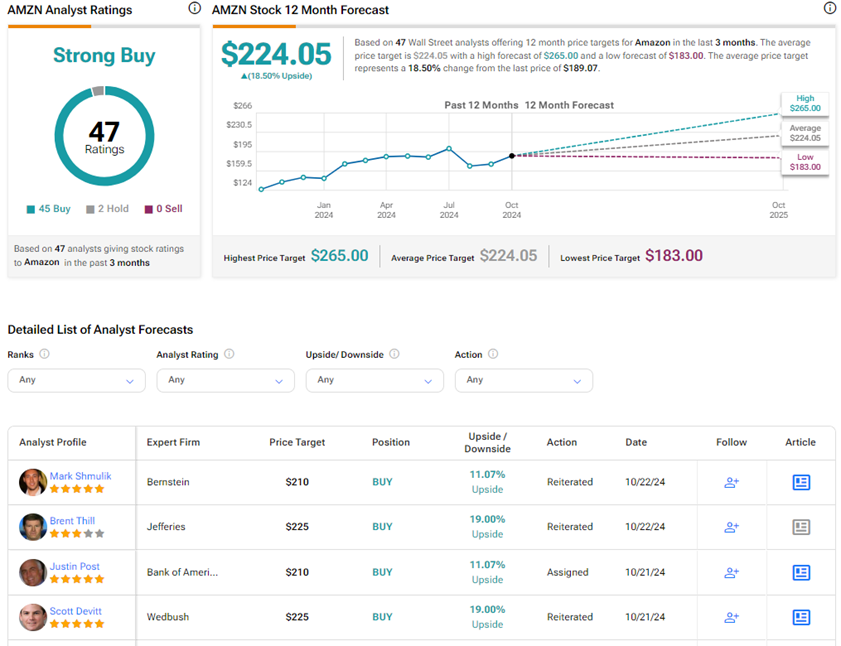

Wall Street is highly optimistic about Amazon stock’s trajectory, thanks to its wide array of services including retail, Amazon Web Services, and Amazon Logistics.

On TipRanks, AMZN stock has a Strong Buy consensus rating based on 45 Buys versus two Hold ratings. Also, the average Amazon.com price target of $224.05 implies 18.5% upside potential from current levels. Year-to-date, AMZN shares have gained 24.4%.