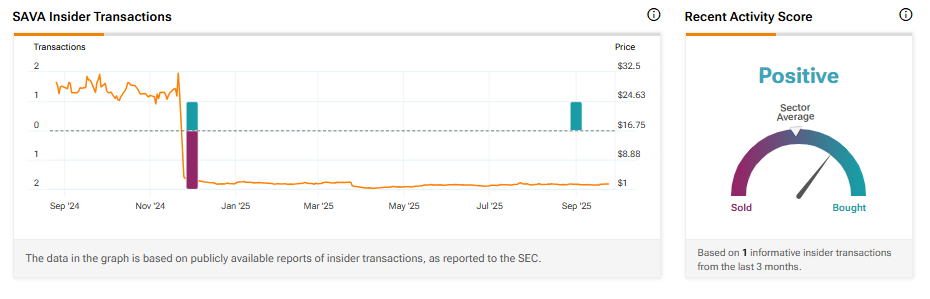

Cassava Sciences (SAVA) CEO Richard Barry bought 237,941 shares at prices ranging between $2.13-$2.29 per share, totaling $534,743. The move comes just weeks after Cassava announced it would discontinue development of its Alzheimer’s drug, simufilam, following disappointing Phase 3 trial results. Following the news, SAVA stock soared 50% during Tuesday’s trading session.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The insider buy is Barry’s first in over a year and is being seen as a signal of confidence in the company’s future. It suggests he sees value in Cassava’s remaining pipeline and long-term strategy.

Cassava stock had plunged more than 90% over the past year, largely due to the failed REFOCUS-ALZ trial.

Bullish Insider Sentiment for SAVA Stock

Based on informative insider transactions from the last three months, Barry is the only insider who has purchased SAVA stock. Overall, TipRanks’ Insider Trading Activity Tool shows that insider confidence in the stock is currently Positive.

Investors may benefit from keeping an eye on transactions made by key insiders, as these transactions typically reflect their confidence in the company’s prospects. Interestingly, TipRanks offers daily insider transactions as well as a list of top corporate insiders. It also provides a list of hot stocks that boast either a Very Positive or Positive insider confidence signal.

Is SAVA a Good Stock to Buy Now?

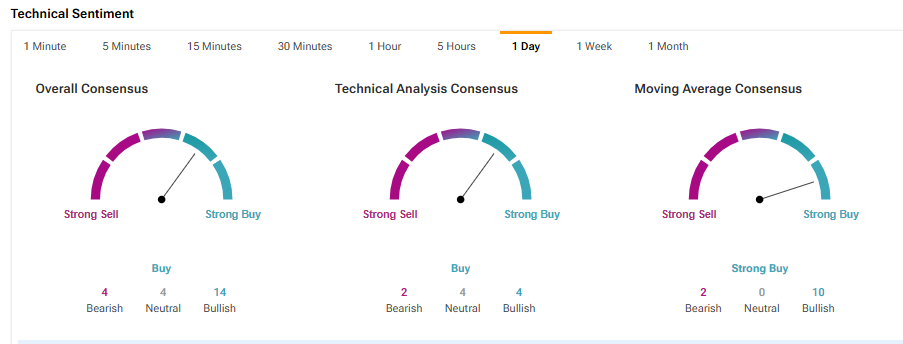

Overall, on the one-day time frame, SAVA stock is a Buy, according to TipRanks’ easy-to-read technical summary signals. This is based on 14 Bullish, four Neutral, and four Bearish signals.