Caroline Ellison, former CEO of Alameda Research, has been sentenced to 24 months in prison for her involvement in the FTX collapse. In addition to the prison time, she’s been ordered to forfeit a staggering $11 billion. This marks an important moment in the fallout from one of crypto’s biggest scandals.

Ellison Admits Guilt in FTX Collapse

Ellison pleaded guilty to multiple charges, including wire fraud and conspiracy counts, back in December 2022. According to Bloomberg, her “extraordinary” cooperation with the government played a major role in reducing her sentence. Judge Lewis Kaplan, who handled the case, highlighted Ellison’s swift and full confession compared to Sam Bankman-Fried’s inconsistent testimony. He remarked, “I’ve never seen one quite like Ms. Ellison,” praising her honesty during the investigation.

Ellison Helped Seal Bankman-Fried’s Fate

Ellison was a key witness in Bankman-Fried’s trial. She helped prosecutors build a swift case against him by cooperating so quickly and thoroughly that it prevented him from fleeing the Bahamas, according to court documents. John J. Ray, the new CEO of FTX, also praised her for aiding in the recovery of customer assets.

Moreover, Ellison’s remorse seemed genuine. In a taped confession she didn’t know would surface, she apologized to her staff, further cementing her role in bringing the truth to light.

Despite her cooperation, Ellison has faced severe public fallout. Her private diaries were leaked, and she’s endured harsh criticism, especially from parts of the crypto community. Her lawyers have stated she’s been harassed and has struggled to find work since the collapse.

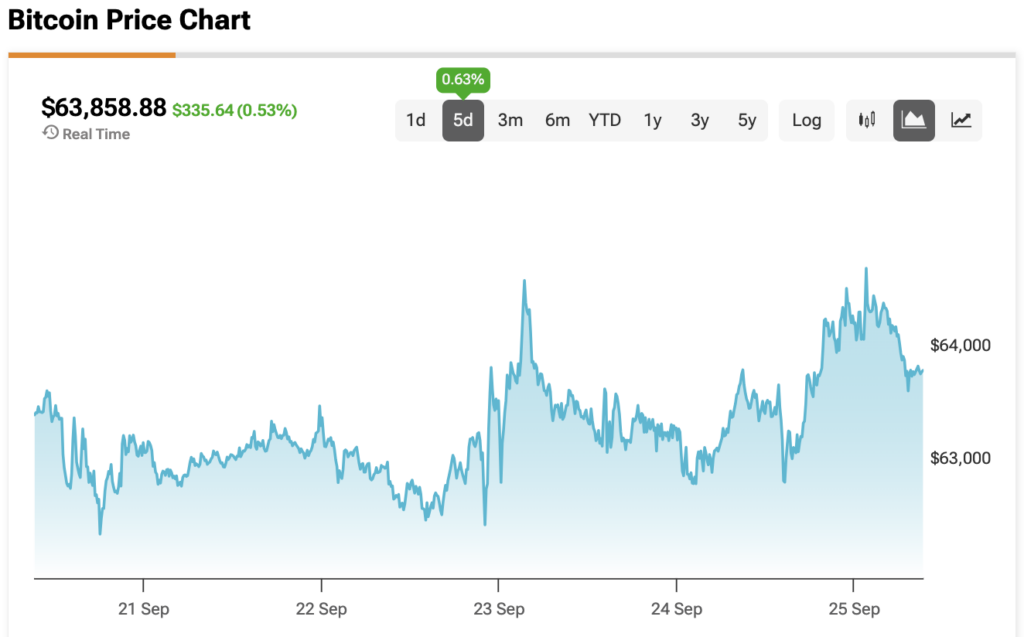

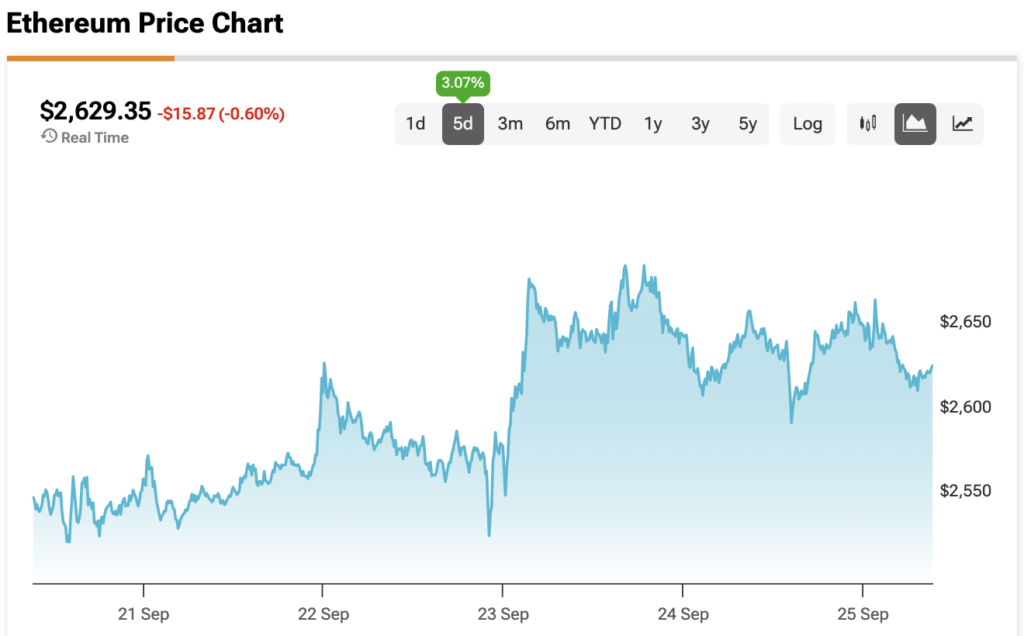

How Has FTX’s Collapse Impacted Bitcoin and Ethereum?

Bitcoin (BTC-USD) and Ethereum (ETH-USD), the two largest cryptocurrencies by market cap, have also felt the effects of the FTX collapse. Bitcoin remains the most established digital asset, while Ethereum’s role in decentralized finance and smart contracts drives its ongoing influence. Both assets have faced volatility as regulatory scrutiny increases after scandals like FTX, leaving investors and institutions to question how future regulations might affect their growth and adoption. Despite these challenges, Bitcoin and Ethereum continue to hold dominant positions in the crypto market.

At the time of writing, Bitcoin is sitting at $63,858.88 and Ethereum at $2,629.35.