While the proper use of debt can offer a way to finance major purchases in smaller, bite-sized chunks, there is something to be said for paying debt off and removing interest expenses. Canadian cannabis stock Canopy Growth (TSE:WEED) did just that when it paid off a large chunk of its term loan. Shareholders were pleased with this bit of fiscal responsibility and gave Canopy Growth a fractional boost to its shares in Thursday morning’s trading.

Canopy Growth shelled out a hefty $100 million prepayment recently, which went to its senior secured term loan. The payment was ahead of schedule, and in so doing, Canopy automatically got the loan’s term extended to December 18, 2026.

With that prepayment—which actually only cost $97.5 million thanks to a small discount—Canopy looks to save itself around $14 million per year in annualized interest that it no longer needs to pay. That gives its balance sheet some new life and helps position the company for more sustainable growth down the line. In fact, Canopy may be able to make one more such payment in March 2025, which would automatically extend the loan once more to September 2027.

Debt and Acquisitions

The particularly interesting part here is that Canopy is not just funneling all its spare cash into debt servicing. In fact, Canopy USA—part of Canopy Growth—just acquired the Wana brand. This includes not only Wana proper, but also Wana Wellness, The CIMA Group, and Mountain High Products.

With the acquisition of Wana, Canopy now has a larger presence in the United States marijuana market, which looks to make significant progress as more states allow the substance to be sold legally within their borders. Given that both Kamala Harris and Donald Trump have offered support for federal-level rescheduling of marijuana, that market could be more substantial still in the months to come.

Is Canopy Growth a Buy or Sell?

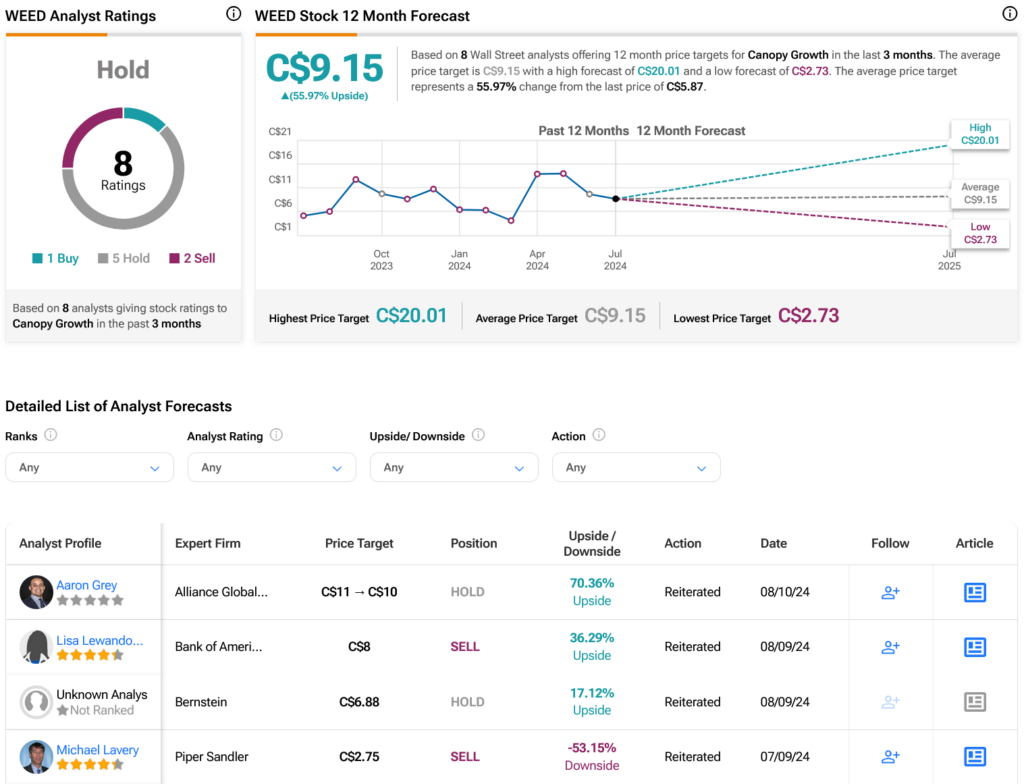

Turning to Wall Street, analysts have a Hold consensus rating on TSE:WEED stock based on one Buy, five Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 28.41% loss in its share price over the past year, the average TSE:WEED price target of C$9.15 per share implies 56% upside potential.