Cano Health (NYSE: CANO) reported weaker-than-expected Q4 results, missing both earnings and revenue estimates.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

However, despite the quarterly miss, shares of the leading health care services provider for seniors serving both Medicare and Medicaid patients in the U.S., gained over 8% during the extended trading session on March 14, following raised FY2022 outlook ahead of analyst expectations.

Weak Q4 Results

The company reported an adjusted loss of $0.12 per share, which was much worse than the street’s estimated loss of $0.02.

Further, revenues jumped 90% year-over-year to $492.3 million, but lagged consensus estimates of $531.65 million.

The year-over-year increase in revenues reflected a surge in total membership, which increased 115% to 227,005 members, while Medicare capitated members grew 69% to 125,999.

Raised FY2022 Outlook

Based on the net positive impact from the current restatement of accounts worth $69 million and excluding the impact from acquisitions, the company raised its guidance for full-year 2022 versus the prior outlook provided on November 9, 2021.

The company now forecasts adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) in the range of $230 million to $240 million, higher than prior guidance of $170 million to $175 million.

Notably, revenues are forecast to be in the range of $2.8 billion to $2.9 billion, versus the previous range of $2.6 to $2.7 billion, and also higher than the consensus estimate of $2.64 billion.

For the full year, total membership is now projected to range between 290,000 to 295,000, which is higher than prior guidance of 280,000 to 285,000.

Further, the company intends to further expand clinical capacity during the year without the need for additional financing. It targets to operate 184 to 189 medical centers by the end of 2022, compared to 130 medical centers as of December 31, 2021.

CEO Comments

Looking ahead, Cano Health CEO, Dr. Marlow Hernandez, commented, “We exceeded our most recent membership guidance and expanded our clinical capacity in eight states and Puerto Rico, allowing us to accelerate growth in 2022. Since founding the company over 10 years ago, I have never been more excited about what the Cano Health team is going to accomplish this year.”

Wall Street’s Take

Consensus among analysts is a Strong Buy based on 3 unanimous Buys. The average Cano Health stock price projection of $14.67 implies 153.37% upside potential to current levels, at the time of writing.

Investors Weigh In

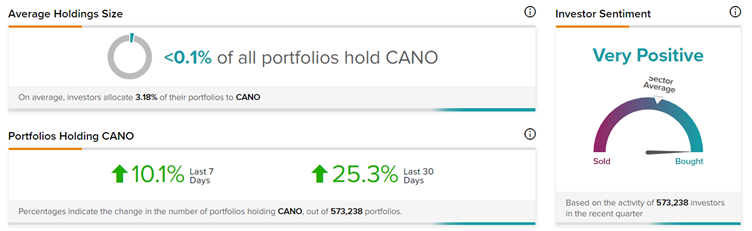

TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Cano Health, with 25.3% of investors increasing their exposure to CANO stock over the past 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Inspired Entertainment Surges 11.6% on Q4 Revenues Beat

Sunworks Sinks 18.3% on Wider-Than-Expected Q4 Loss

Harpoon Therapeutics Tanks 27.4% on Q4 Miss & Discontinuation of HPN424 Study