One of the big problems for most cannabis stocks—and cannabis operations in general—is that they had to be cash-only businesses, for the most part. With that much cash on hand, they became targets for opportunistic thieves seeking an easy score. But now, cannabis stocks are largely up in today’s trading thanks to some new action brewing in the United States Senate about opening up banks to marijuana businesses. Reports note that the SAFE Banking Act—which would open up banks to legal cannabis operations—has a “pretty good” level of bipartisan support.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While some would be opposed to a law about marijuana that isn’t its outright ban, the SAFE Banking Act can likely count on a little more support thanks to its focus on banking and reducing crime. Taking the cash-only marijuana businesses and giving them access to cards and checks and easy deposits should make them safer, which means the streets surrounding them are similarly safer as well.

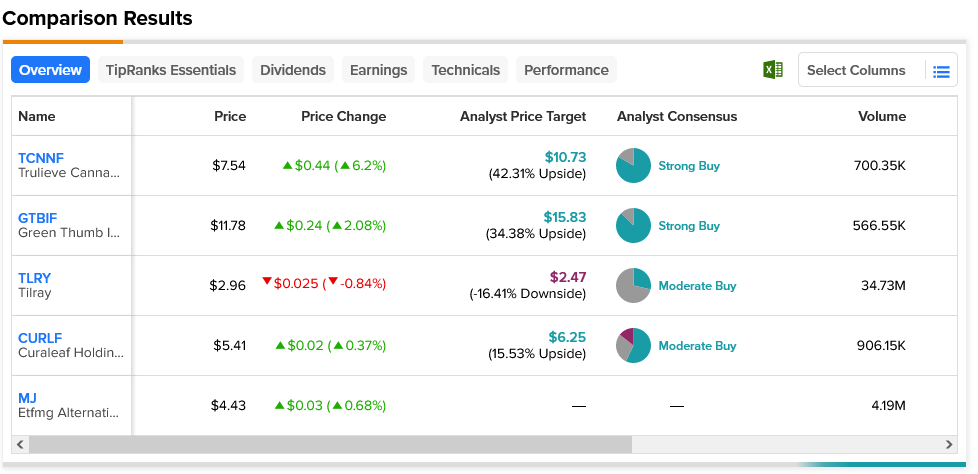

Some of the gains were more substantial than others. Some even lost some of their gains. For instance, the big winner in Friday afternoon’s trading was Trulieve Cannabis (OTHEROTC:TCCNF), which added over 6% at one point. Green Thumb Industries (OTHEROTC:GTBIF) notched up almost 1.5%, and Etfmg Alternative Harvest ETF (NYSEARCA:MJ) was up fractionally. Meanwhile, both Tilray (NASDAQ:TLRY) and Curaleaf Holdings (OTHEROTC:CURLF) slipped fractionally in Friday afternoon’s trading.

Meanwhile, there’s a broad level of support for these weed stocks from analysts. Trulieve Cannabis has the lead in terms of expected price gains. With an average price target of $10.73, this Strong Buy comes with 42.31% upside potential. Meanwhile, Tilray—a Moderate Buy—comes with 16.41% downside risk on its $2.47 average price target.