Anyone who’s been shopping for a home lately knows that they’re difficult to come by and expensive when you actually find something. And there’s not going to be much relief for homebuyers in 2024, at least not in Canada. A new survey from Royal LePage notes that prices were on the rise, and they’ll likely continue in that vein through 2024. Meanwhile, the iShares S&P/TSX Capped REIT Index ETF (TSE:XRE) is taking things reasonably well, up fractionally in Monday afternoon’s trading.

The survey revealed that Canadian home prices, in aggregate, rose 4.3% year-over-year in the fourth quarter. 2024 won’t produce much relief, and the prices will continue to rise going into 2024. The current average price in Canada, according to the survey, was $789,500. Interestingly, prices dropped 1.7% on a quarterly basis in response to rising interest rates that kept many potential homebuyers out of the market.

Is a Recovery Already Starting?

You could be forgiven for believing that the housing market in Canada is about to experience a full-on freeze. But there are signs that a recovery could be in the works, even before the Bank of Canada starts cutting interest rates. The Royal LePage report notes that such a recovery may be in the works as the market is nearing a “tipping point,” which will prompt recovery regardless of what the Bank of Canada does. Though, certainly, a cut in interest rates would help fire things up—it would open up the floor to more buyers that way—housing is one of those necessities that’s constantly sold regardless of the lending environment.

Is XRE a Good Buy Right Now?

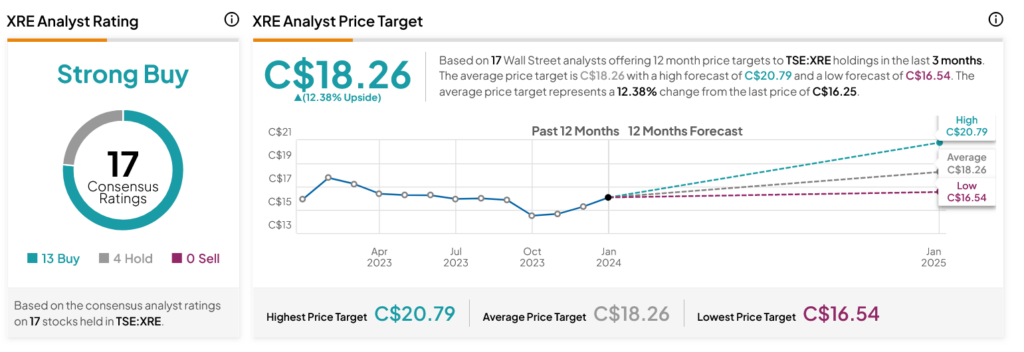

Turning to Wall Street, analysts have a Strong Buy consensus rating on XRE stock based on 13 Buys and four Holds assigned in the past three months, as indicated by the graphic below. After a 5.12% loss in its share price over the past year, the average XRE price target of C$18.26 per share implies 12.38% upside potential.