Oil stock Canadian Natural Resources (TSE:CNQ) turned in its earnings report earlier today, and the news was mixed. However, this did not daunt investors, who gave Canadian Natural a fractional boost in Thursday morning’s trading. Canadian Natural posted earnings per share that proved a match for the same quarter a year prior, with both periods coming in at $1.06 per share.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

However, the third-quarter profit came in at $2.27 billion, which was down from the $2.34 billion posted back in 2023’s third quarter. Total sales were also down, with $10.4 billion for this quarter against $11.76 billion a year prior. Further, daily oil production fell, with the average for the quarter coming in at 1,363,086 barrels per oil equivalent per day. A year prior, that average was 1,393,614.

Adjusted earnings also proved a disappointment, coming in at $0.97 per share against $1.30 per share from 2023’s third quarter. Yet, this did beat analyst expectations; TipRanks data looked for earnings of $0.90 per share.

Dialing Back on Natural Gas Wells

It may surprise some here, but Canadian Natural is planning to dial back its drilling operations in terms of new natural gas wells. This may seem odd in light of the fact that production is down, but there actually is a good reason, economically speaking. The drilling will slow because prices are down overall, so Canadian Natural plans to hold off for a bit until prices recover.

Interestingly, natural gas prices were already at the lowest levels seen in two years during the July-September quarter. In fact, storage throughout Alberta was largely maxed out thanks to declining overall demand. With early reports suggesting a warm November throughout much of North America, the call for natural gas should remain subdued for a while.

Is Canadian Natural Resources Stock a Buy?

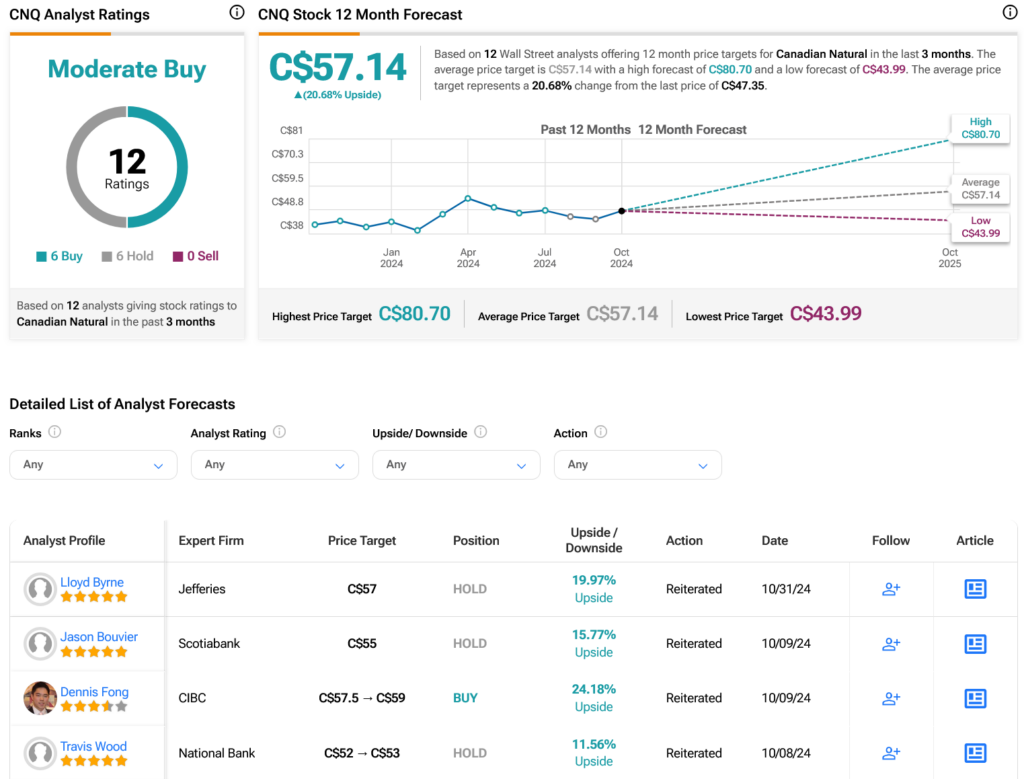

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:CNQ stock based on six Buys and six Holds assigned in the past three months, as indicated by the graphic below. After a 10.87% rally in its share price over the past year, the average TSE:CNQ price target of C$57.14 per share implies 20.68% upside potential.