Well, the news has already kicked off for 2025, and the ink is not yet dry for 2024. But Canadian railroad giant Canadian National Railway (TSE:CNR) is already starting things off with a bang, and a strike. The news did not do much harm to share prices, though, as Canadian National shares were up modestly in Monday morning’s trading.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

The word out of Unifor, the union that works with Canadian National Railway, is that a “strike action” has officially been authorized on January 1. That does not mean a strike will happen that day, of course, but rather that one is ready if it is needed. Should Unifor and Canadian National fail to reach a contract agreement by then, then a strike will follow. But if there is a contract in place on that day, then no strike will be necessary.

With over 3,600 members to its credit, a Unifor strike would do quite a bit of damage to Canadian National’s operations. Given that the Unifor membership “overwhelmingly” voted in favor of the strike, too, according to reports, the end result is that there is likely quite a bit of discontented laborers. But negotiations are on track and are set to run from November 30 to December 8 in Montreal. Negotiations have been going on since September, though, which is not a good sign.

Growing Interest

While the labor picture at Canadian National is not exactly looking great, there are some positive signs afoot. In fact, reports note that Canadian National is considered a “…profitable, growing company.” Over the last three years, the reports noted, Canadian National has raised its earnings per share (EPS) figures by 9.1% on a yearly basis.

Further, those same reports noted that more insiders were getting into Canadian National stock than were getting out. Insiders sold stock valued at C$2.9 million but bought stock worth C$3.8 million. The Independent Chair of the Board, Shauneen Bruder, actually made the single largest share purchase in the past 12 months, picking up C$1 million alone.

Is Canadian National a Good Stock to Buy?

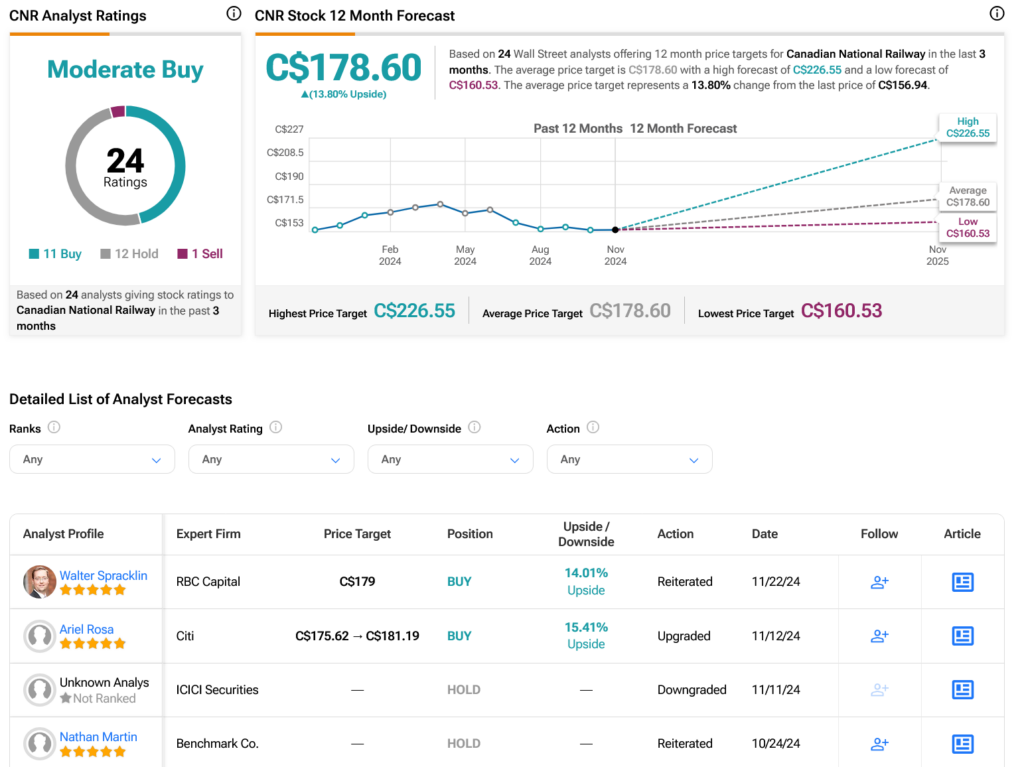

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:CNR stock based on 11 Buys, 12 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 5.05% rally in its share price over the past year, the average TSE:CNR price target of C$178.60 per share implies 13.8% upside potential.