The world of electric vehicles is getting set for a major upheaval, and Tesla (NASDAQ:TSLA), the reigning market leader, may face some serious competition. According to the Wall Street Journal, two South Korean names, Hyundai Motor (OTC:HYMLF) and Kia (OTC:KIMTF), jointly grabbed the second position in EV sales in the U.S. last year. Both companies are part of the Hyundai Motor Conglomerate.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Further, Hyundai and Kia could solidify their market share gains over non-Tesla EV makers in 2024 with new model introductions and pricing maneuvers. Remarkably, both companies grew faster than Tesla and the EV market in 2023 by taking advantage of the EV tax credit rules, offering purpose-built models, and finding newer ways of reaching customers, such as selling cars online on Amazon (NASDAQ:AMZN).

While Tesla still commands over half of the EV market pie in the U.S., its hold over the market is weakening. Globally, Chinese automaker BYD (HK:1211) (OTC:BYDDF) is inching ever closer to taking the top slot in EV sales.

Despite tepid EV sales and rising competition being some points of concern for the EV industry as a whole, Tesla may be looking at some problems of its own. Apart from concerns that Elon Musk may be spreading himself too thin amongst his ventures, ranging from colonizing Mars, planting chips in monkeys, and owning social media platforms, his use of illegal drugs has leaders at his companies worried as well. Additionally, Musk’s latest demand for a 25% voting control in Tesla before driving the company’s growth in AI and robotics adds another twist to the Tesla story.

Is Tesla Stock Expected to Rise?

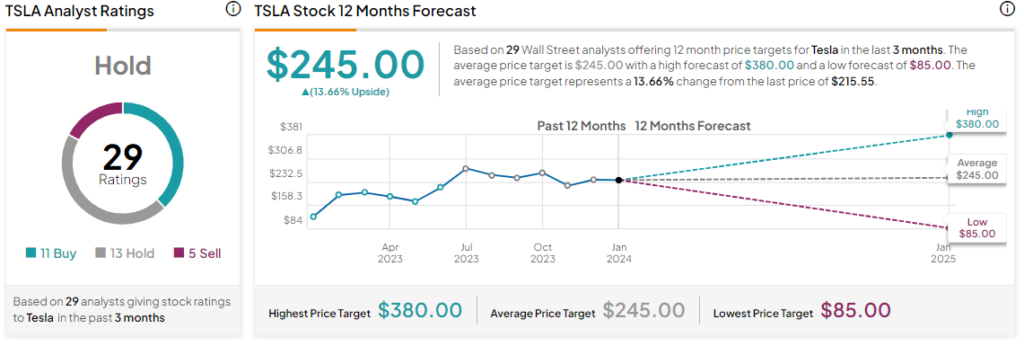

Not surprisingly, Tesla’s share price has declined by over 13% so far this month. Overall, the Street has moved to a Hold consensus rating on Tesla, and the average TSLA price target of $245 implies a modest 13.7% potential upside in the stock.

Read full Disclosure