The stock market is not easy to please at times. Stocks often get punished for not delivering on all fronts when reporting earnings, even if the print had plenty going for it.

This brings us to Snowflake (NYSE:SNOW), whose shares tumbled nearly 15% last Thursday despite the company surpassing expectations on several key metrics in its Q2 report. Revenue rose by 28.9% to $868.82 million, beating the consensus estimate by $18.67 million, while at the bottom line, adjusted EPS of $0.18 outpaced expectations by $0.02.

Looking ahead, Snowflake guided Q3 product revenue to range between $850 million and $855 million, slightly above the $851 million analysts had anticipated.

Overall, things are looking pretty good. However, the share price drop can be attributed to several factors. While the top-line guidance surpassed expectations, it may not have aligned with the high hopes investors had. Moreover, billings reached $779 million, missing the $831.9 million projected by analysts, and the net loss expanded to $317.77 million, up from $227.32 million in the same quarter last year. Though the revenue retention rate remains robust at 127%, it’s trending in the wrong direction.

Nonetheless, Canaccord analyst Kingsley Crane notes that the report had several positive aspects and believes the recent drop in share price presents a buying opportunity for investors.

“Bigger picture,” said Crane, “FCF margins remain strong at 26%, and we expect that the market will place a greater valuation emphasis on SNOW’s growth prospects. To that end, Q2 was a step in the right direction. cRPO growth of ~30% in both of the last two quarters suggests FY25 product revenue growth guide of 25% is more than reasonable. We continue to see a buying opportunity in these trading ranges for a company well positioned to capitalize on an ongoing customer investment cycle in data management.”

To this end, Crane rates SNOW shares a Buy, while his $190 price target implies ~64% upside potential from current levels. (To watch Crane’s track record, click here)

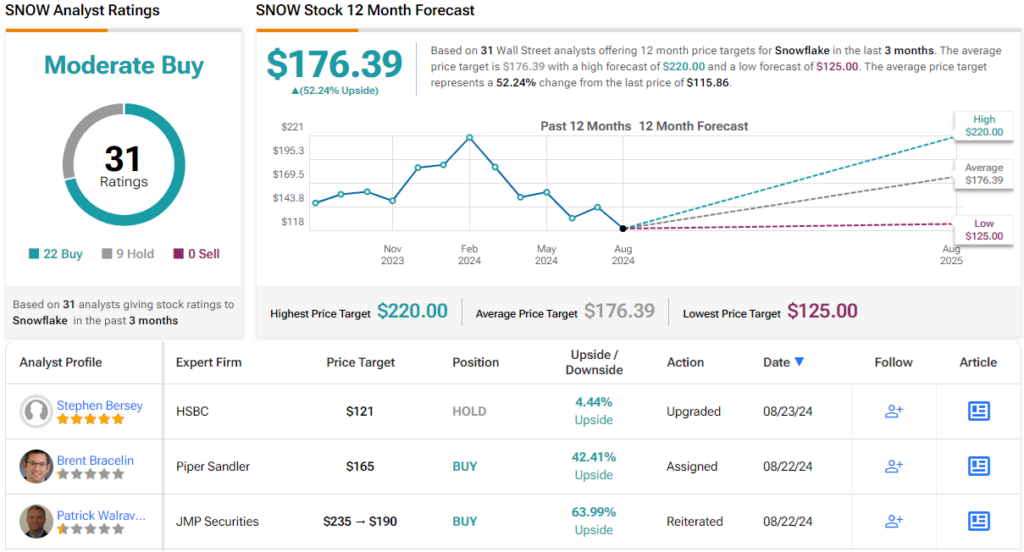

Elsewhere on the Street, the stock claims an additional 21 Buys and 9 Holds, for a Moderate Buy consensus rating. The average target stands at $176.39, suggesting shares will gain 52% in the year ahead. (See Snowflake stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.