No doubt about it, Rivian Automotive (NASDAQ:RIVN) is off to a rough start in 2024. Since the calendar flipped, shares of this electric truckmaker have lost an astounding 34% of their value – despite apparently reaching its goal of ramping production of R1T electric trucks and R1S electric SUVs to 65,000 units per year by the end of 2023, and despite promising to turn gross-profitable by the end of 2024.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Not all analysts have thrown in the towel on Rivian stock, however.

In a research update, Tigress Financial’s Ivan Feinseth, a 5-star analyst rated in the top 4% of the Street’s stock pros, reiterated a Buy rating on Rivian stock, and doubled down on his prediction that the stock will more than double this year, to a target price of $36 per share. (To watch Feinseth’s track record, click here)

“RIVN continues to see strong demand and business trends for its industry-leading pick-ups and SUVs,” argued the analyst, and has ramped production to meet this demand, even as it positions itself to expand production of commercial electric vans for customers such as Amazon.com and AT&T.

In addition, on top of Rivian’s prediction that it will begin earning at least a gross profit (but not an operating profit and definitely not a net profit) by the end of this year, Feinseth predicts that negotiations for price reductions from its suppliers, combined with greater production, more leasing of its vehicles, and greater efficiencies of scale, will enable Rivian to turn “cash flow profitable” (but not free cash flow positive) in 2025.

On the other hand, though, Rivian only has about $9.6 billion in cash left in its bank account, and it’s currently burning through cash at the rate of $6.2 billion per year. If Rivian doesn’t turn free cash flow positive in 2025, it actually seems more likely that the company will run out of cash before next year is through. And indeed, in his report, Feinseth seems to admit this is possible, arguing that the company will “fund ongoing innovation, new product development, expanding support services, and new growth opportunities” not only with its “balance sheet,” but also with its “future access to the capital markets.”

So how does Feinseth address the risk that Rivian will need to add leverage to its balance sheet, and dilute its shareholders, to keep the doors open and the lights on? Feinseth’s perspective is that Rivian has a substantial opportunity with a total addressable market estimated at $9 trillion for its products. It’s worth noting, however, that Rivian’s annual sales for the past year amounted to $3.8 billion, and according to market researcher IBISWorld, the current global car market is valued at approximately $4.3 trillion.

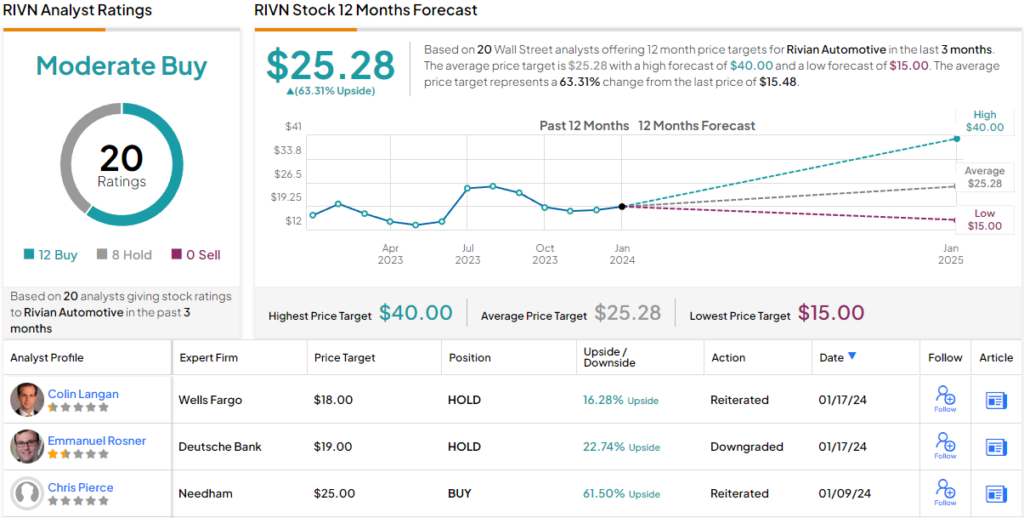

So, that’s Feinseth’s view. Let’s have a look at what the rest of the Street has in mind for RIVN shares. Based on 12 Buys and 8 Holds, the analyst consensus rates RIVN a Moderate Buy. Going by the $25.28 average price target, the shares are anticipated to surge ~63% over the next 12 months. (See RIVN stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.