Rivian (NASDAQ:RIVN) stock has endured a nightmare 2024, crashing by 55% throughout the year. Yet, the company’s Q3 report provided some relief.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Not that the readout was stellar in any way; in fact, the EV maker missed on both the top and bottom lines. Revenue fell by 35% year-over-year to land at $874 million, falling short of the consensus estimate by $136 million. Adj. EBITDA of (757) million dragged on the (645) million EBITDA the Street was expecting. At the bottom line, adj. EPS of -$0.99 missed the forecast by $0.09.

Given a component shortage, Rivian had previously lowered its production guide for the year but that stayed the same at between 47,000 to 49,000 while the 2024 delivery forecast also remained at 50,500-52,000. However, the company is now expecting the FY24 EBITDA loss will be $150 million worse than in its prior guide, with Rivian anticipating a $(2.875) billion loss compared to a $(2.825) billion loss beforehand.

So, that all sounds rather bleak and a good enough reason for investors to give the shares a bit more of a kicking. But that didn’t happen, and that’s possibly down to the fact sentiment was already low and investors knew what was coming. Additionally, as Stifel analyst Stephen Gengaro notes, there were also some positives to take away from the readout.

First off, the company said the R2 launch is still on track for the first half of 2026. And Rivian also remains confident in a “modest positive” 4Q24 gross profit, although that relies on the anticipated $275 million from regulatory credit sales. Ongoing cost reductions and efficiency improvements are also expected.

But possibly most important of all right now, the Volkswagen deal is still expected to close this quarter and that should “significantly boost liquidity” and open up further opportunities.

“We believe the Joint Venture (expected to close by year-end) with Volkswagen, especially given it being a globally renowned brand, provides Rivian a substantial platform to showcase its technology leadership, opening the door for potential opportunities for Rivian to be a technology partner with other OEMs,” Gengaro opined.

“Overall,” the analyst summed up, “we view the print and outlook as about neutral for the shares near term, and supportive of our positive longer-term view for RIVN.”

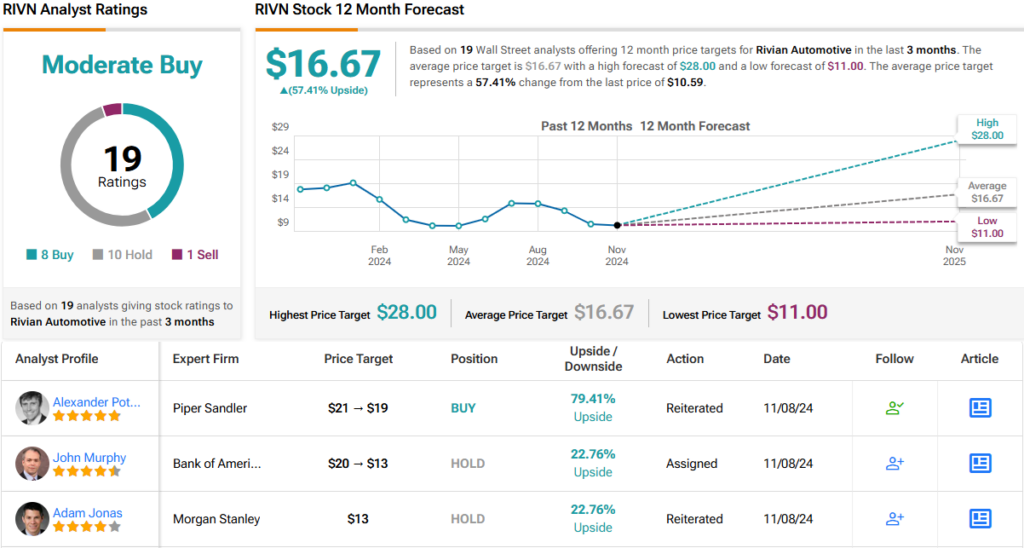

Accordingly, Gengaro rates RIVN shares a Buy, along with an $18 price target, suggesting the stock will climb 70% higher over the coming months.

The Street’s average price target is only a little lower; at $16.67, the figure makes room for one-year returns of 57%. On the rating front, based on 8 Buys, 10 Holds and a single Sell, the analyst consensus rates the stock a Moderate Buy. (See Rivian stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.