Enterprise AI software provider C3.ai (NYSE:AI) will release its fiscal fourth-quarter results after the market closes on Wednesday, May 29. The company’s performance might have benefited from strong demand for generative AI solutions during the quarter. However, C3.ai’s high customer acquisition costs and rising marketing expenses are likely to have impacted its bottom line.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Since March 2021, C3.ai has consistently beaten analyst estimates in every quarter. However, investors should note that the company is far from becoming profitable.

AI – Q4 Expectations

Wall Street expects C3.ai to report sales of $84.39 million in Q4, up about 17% year-over-year. Meanwhile, analysts expect the company to post a loss of $0.30 per share, wider than the loss of $0.13 reported in the prior-year quarter.

According to the TipRanks Stock Analysis tool, “Bulls Say, Bears Say,” analysts bearish on AI warn of potential financial instability.

Options Traders Anticipate a Large Move

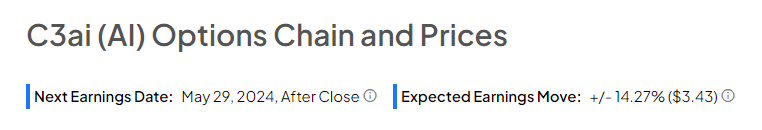

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry; the Options tool does this for you. Indeed, it currently says that options traders are expecting a large 14.27% move in either direction.

Is AI Stock a Good Buy?

Overall, Wall Street is sidelined on the stock. It has a Hold consensus rating based on three Buy, seven Hold, and three Sell recommendations. The analysts’ average price target on C3.ai stock of $30.55 suggests an upside of 27.08%. Shares of the company have declined 16.3% year-to-date.

Concluding Thoughts

The company is benefiting from strong momentum in demand for enterprise AI solutions. However, rising expenses and a lack of initiatives to control costs remain key concerns. As a result, C3.ai’s path to profitability remains unclear.