Byrna Technologies (BYRN) is making bold strides in the less-lethal personal security market with promising products, robust marketing strategies, and exceptional financial growth. Its stock is over 149% year-to-date, and with the manufacturing capacity ramped to 18,000 units per month and a pocket-sized product soon to hit the market, Byrna is well-positioned for a continued upward trajectory. According to preliminary unaudited results for the fiscal third quarter of 2024, the company anticipates a whopping 194% increase in total revenue ($20.8 million) compared to the same period last year ($7.1 million).

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

This remarkable surge is attributed to the success of the company’s out-of-the-box marketing efforts, including a high-profile celebrity endorsement campaign. Byrna’s unique market position, financial strength, and upside potential make it an intriguing opportunity for investors interested in a non-lethal play in the defense industry.

Byrna Expanding its Total Addressable Market

Byrna Technologies is a self-defense technology company that produces less-lethal personal security solutions. Its product lineup features handheld personal security devices and shoulder-fired launchers that don’t require a background check or firearms license, catering to both consumers and professional security customers.

The company’s lead product, the Byrna, is a cutting-edge handheld launcher powered by CO2. Byrna has innovated its 68-caliber launchers with a patented first-shot, pull-pierce technology. This enhancement allows the CO2 cylinder to stay unpunctured in the launcher until it’s used, contrary to its counterparts, which leak CO2 in 24 hours. Consequently, the Byrna launcher retains its capability regardless of how long it has been inactive, whether a week, month, year or several years.

The company believes its total addressable market (TAM) is roughly $17.5 billion across the global markets in which it operates, including the United States, South Africa, Europe, South America, Asia, and Canada.

Analysis of Byrna’s Recent Financial Results

The Company has released preliminary unaudited results for the fiscal third quarter of 2024, with revenue expected to reach $20.8 million, marking a 194.2% increase from the $7.1 million in total revenue generated during the same period in 2023. The increase has been driven by robust sales in both Direct-to-Consumer and Dealer & Distributor segments. A breakdown of the sales channels reveals that web sales saw the most notable increase of 219.6%.

In addition, dedicated dealer sales rose by 146.1%, traditional dealer sales by 113.5%, law enforcement sales by 49%, and international sales jumped by an impressive 490.7%.

The Company also achieved a milestone in production during the quarter, manufacturing 55,000 Byrna SD and Byrna LE launchers. This step aligns with Byrna’s announced plan to bolster production volume to 18,000 monthly units.

What Is the Price Target for BYRN Stock?

The stock has surged, climbing over 362% in the past year. It trades at the high end of its 52-week price range of $2.19 – $15.49 and shows positive price momentum by trading above its 20-day (12.48) and 50-day (11.38) moving averages. The explosive growth is reflected in the stock’s premium, with a P/S ratio of 6.2x compared to the Aerospace & Defense industry average of 2.0x.

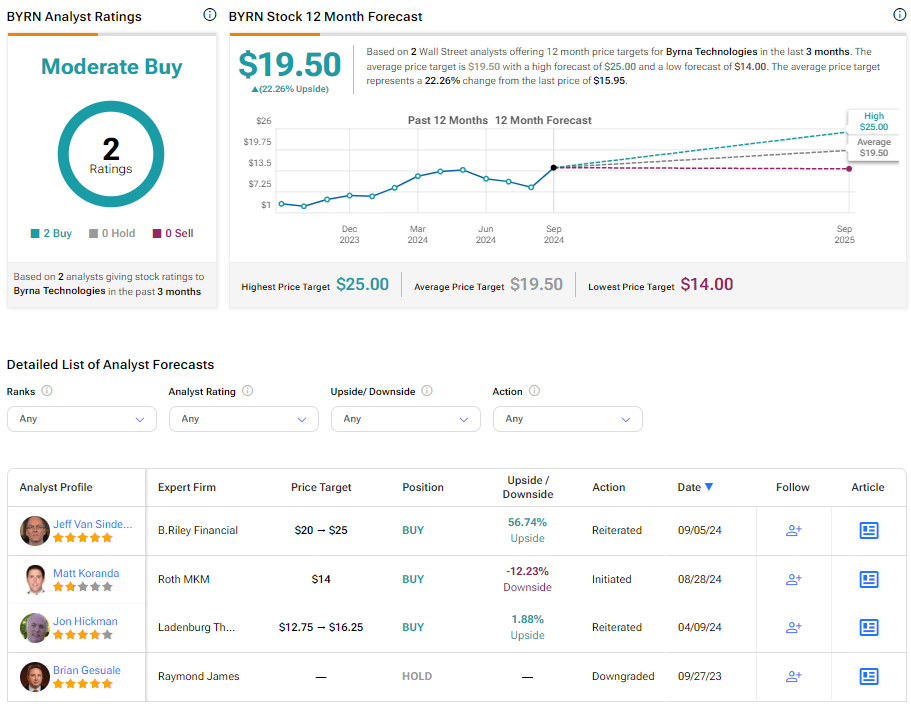

Analysts covering the company have been bullish on the stock. For example, Roth MKM analyst Matt Koranda recently initiated coverage on the stock with a Buy rating and a $14 price target. He noted the company’s leading position in the non-lethal market and forecasts a CAGR of 37% in sales growth.

Byrna Technologies is rated a Moderate Buy based on two analysts’ recent recommendations and price targets. The average price target for BYRN stock is $19.50, representing a potential upside of 22.26% from current levels.

Bottom Line on Byrna

As a front-runner in the less-lethal personal security market, Byrna Technologies is riding its innovative product lineup with astonishing financial results. With an ever-growing total addressable market and expanding global presence, Byrna Technologies continues to promise lucrative upside potential. Its impressive performance positions BYRN as an enticing investment opportunity in the non-lethal personal security sector.