BYD Co. Limited (HK:1211) reported a year-over-year surge of 24% in its H1 profit of ¥13.63 billion. This growth was primarily fueled by strong sales of its electric vehicle (EV) models, despite a slowdown in demand in the Chinese auto market. However, the profit growth rate was slower than the threefold rise seen in the first-half profit in 2023. This slowdown was mainly due to the ongoing price war among EV manufacturers in China and macro uncertainty.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Overall, BYD’s revenue grew by 16% year-over-year to ¥301.13 billion in the first half of 2024. BYD’s Hong Kong-listed shares were down 1.15% as of writing. Year-to-date, BYD stock has gained 6% in trading.

BYD’s Competitor Posts Mixed Results

Meanwhile, BYD’s competitor, Li Auto, Inc. (HK:2015), yesterday reported mixed second-quarter results. It saw a 10.6% year-over-year increase in Q2 revenue and a 25.5% rise in vehicle deliveries. However, Li Auto faced challenges with its gross margin, which dropped to 19.5% from 21.8% in the previous year.

BYD also faced margin pressures in the second quarter, with its Q2 gross margin declining to 18.7% from 21.8% in Q1 2024. However, BYD’s gross margin for H1 increased to 20.0% from 18.3% a year ago.

BYD Aims for 50% Overseas Sales

In the second quarter of 2024, BYD sold a record 986,720 NEVs, marking a 40.25% year-over-year increase and a 57.56% rise from the first quarter. The company attributed this growth to its rising overseas shipments.

Moving forward, the company expects that around 50% of its sales to come from international markets. In the first seven months of 2024, BYD sold 270,000 cars overseas, putting it on track to achieve its full-year target of 500,000 units, representing about 14% of its total sales. To reach its global target, BYD is investing aggressively in production facilities across Europe, Asia, and South America.

Is BYD Stock a Good Buy?

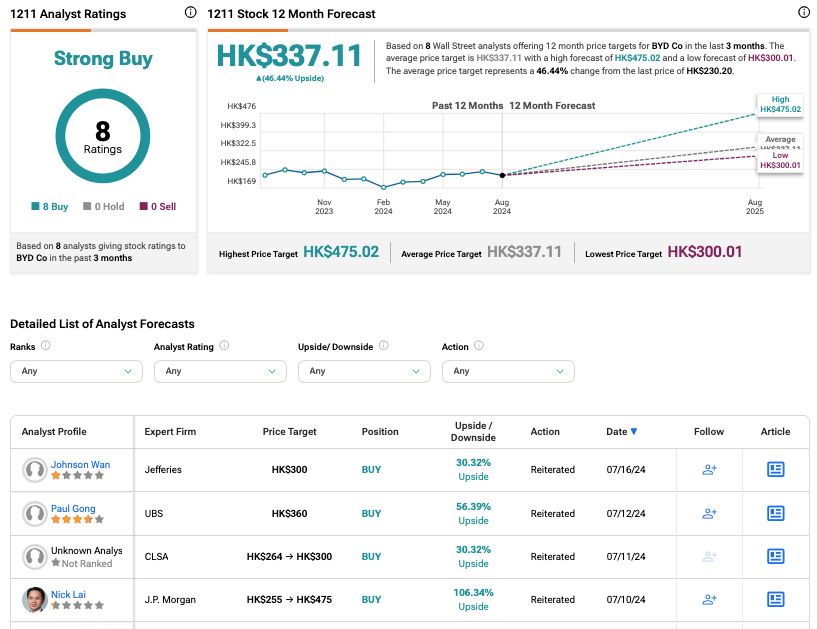

According to TipRanks, 1211 stock has received a Strong Buy rating, backed by eight Buy recommendations. The BYD Co. share price target is HK$337.11, which implies an upside of 46.4% from the current trading level.