Electric vehicle buyers are being showered with more and more choices as EV makers around the globe race to widen their product offerings and drive up sales. One major EV maker making the most of this trend is China’s BYD (HK:1211) (OTC:BYDDF).

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company has churned out a range of affordable EVs to firmly establish itself in the Chinese market. Now, it has expanded this lineup to over 20 models and is moving into the premium category in its overseas push. As part of its overseas strategy, BYD is introducing its cars under a different brand, Yangwang, according to the Wall Street Journal.

Reportedly, some of its offerings include a supercar resembling a Lamborghini and an SUV that features a 360-degree on-the-spot spin and the ability to float on water. In its domestic market, BYD has gradually increased its market share. In comparison, Tesla (NASDAQ:TSLA) has been slowly losing its market share in China. This outperformance has so far helped BYD outrank Tesla as the top-selling EV name in the last quarter. What is common among both names, though, is their rapid pace of setting up new plants. While Tesla has been announcing new plants in markets such as India and Mexico, BYD is setting up facilities in Brazil, Hungary, and Thailand.

Meanwhile, South Korea’s Hyundai Motor (OTC:HYMLF) and Kia (OTC:KIMTF) are clocking rapid market gains in Tesla’s home turf. The two companies jointly grabbed the second position in EV sales in the U.S. last year on the back of new model introductions and pricing maneuvers. Additionally, capitalizing on the latest tweaks to the EV tax credit rules, and nifty ways of reaching customers, such as selling cars online on Amazon (NASDAQ:AMZN), have also helped.

For BYD, its overseas ambitions could hit a speed bump in the form of increasing regulatory scrutiny in Europe and tariffs in the U.S. The company aims to ship over 400,000 vehicles abroad in 2024.

Can BYD Beat Tesla?

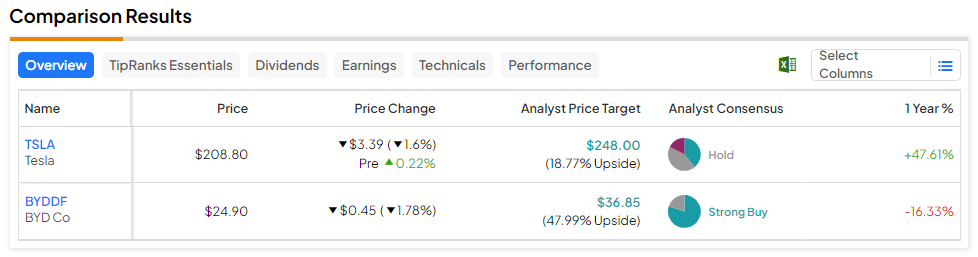

Despite BYD’s market gains and global expansion spree, shares of the company have tanked by more than 16% over the past year amid a broader rout in Chinese equities. Tesla, on the other hand, has soared by over 47% as the broader U.S. markets moved toward new highs. However, the TipRanks Comparison Tool indicates a higher potential upside of nearly 48% in BYD shares over the next 12 months.

Read full Disclosure