Warren Buffett’s investment firm, Berkshire Hathaway (BRK.A) (BRK.B), continues to trim its stake in Bank of America (BAC). In the latest round of sales, the investment giant divested an additional 8.7 million BAC shares, totaling about $370 million as of October 15. This follows a similar sale of 9.5 million shares worth $382.4 million in the previous week, which lowered Berkshire’s stake in the bank to below 10%.

Notably, Berkshire began trimming its BAC stake in mid-July, selling around 33.9 million shares for about $1.48 billion. Since then, Berkshire has netted over $10 billion from these divestments. It should be mentioned that Buffett’s initial investment in Bank of America dates back to 2011, when he purchased $5 billion worth of its preferred stock.

Buffett’s Changing Stance on Banks

Buffett’s recent moves indicate a change in his outlook on the banking sector. Berkshire once maintained stakes in banks such as U.S. Bancorp (USB), Wells Fargo (WFC), and JPMorgan Chase (JPM). However, his remarks at last year’s shareholder meeting highlighted a shift in his perspective regarding the industry.

He expressed concerns about the increased fragility of banks due to the ease of transferring funds between institutions. Furthermore, the challenges posed by rising interest rates have made Buffett less optimistic about the investment potential of smaller banks.

While the exact reasons behind Berkshire’s decision to sell BAC shares remain unclear, several possibilities exist. It could signal a loss of confidence in Bank of America’s prospects, or it might be part of a larger strategy to diversify Berkshire’s portfolio or raise cash for other investments.

What Is the Price Target for BAC Stock?

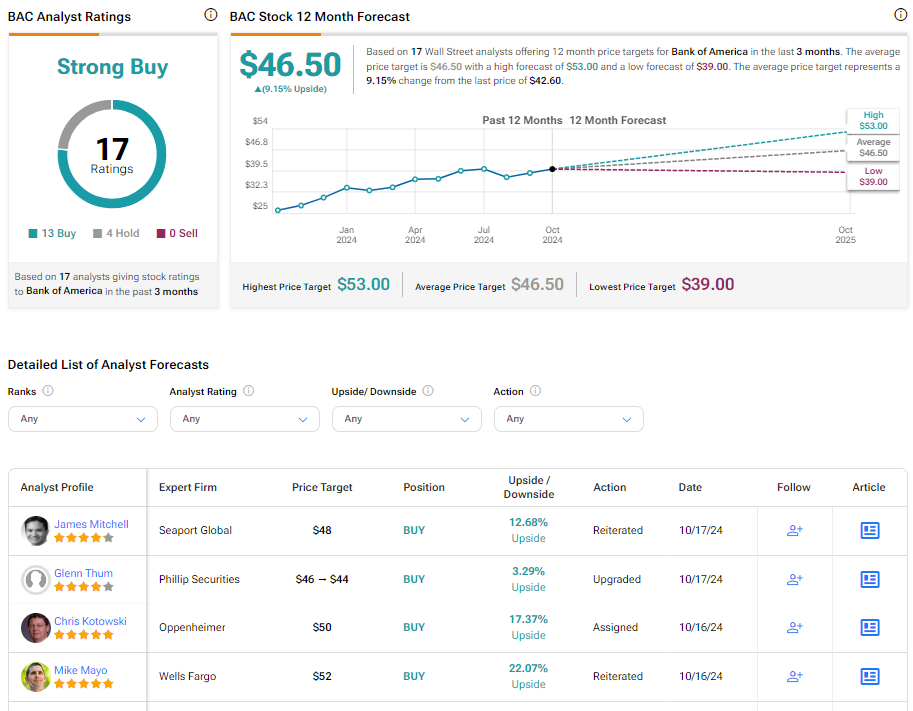

Turning to Wall Street, BAC has a Strong Buy consensus rating based on 13 Buys and four Holds assigned in the last three months. At $46.50, the average Bank of America price target implies 9.15% upside potential. Shares of the company have gained about 29% year-to-date.