Warren Buffett’s Berkshire Hathaway (BRK.A) (BRK.B) made significant portfolio changes during the second quarter. One of the prominent moves was adding new positions in cosmetics retailer Ulta Beauty (ULTA) and aerospace parts maker Heico (HEI). At the same time, the firm sold its entire stake in data management solutions provider Snowflake (SNOW) and trimmed its holdings in tech giant Apple (AAPL).

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

New Bets on Beauty and Aerospace

In the latest 13F filing, Berkshire disclosed that it purchased 690,106 shares of Ulta Beauty, worth about $266.3 million as of June 30. Following the news, ULTA stock gained 13.7% in after-hours trading. Buffett’s decision to invest in ULTA might be influenced by the stock’s favorable valuation, consistent free cash flow, and recent share buyback program.

Alongside ULTA, Buffett’s Berkshire purchased a million shares of Heico. These moves signal Berkshire’s intention to diversify its offerings beyond financial services and industrial sectors.

Other Portfolio Changes

In addition to these new additions, Berkshire’s recent filing disclosed some other notable changes. The company increased its positions in Occidental Petroleum (OXY), Chubb (CB), and Sirius XM Holdings (SIRI).

Meanwhile, Berkshire sold over 389 million APPL shares during the second quarter, though it remains the largest holding in its portfolio. Furthermore, Berkshire offloaded its nearly $1 billion investment in Snowflake.

Beyond trimming its stakes in Apple and Snowflake, Berkshire decreased its holdings in Chevron (CVX), T-Mobile (TMUS), Capital One Financial (COF), Floor & Decor Holdings (FND), and several other companies. Importantly, these sales led to a record-breaking increase in Berkshire’s cash reserves, which surged to $277 billion by the end of Q2.

With this backdrop, let’s take a look at what Wall Street thinks about Berkshire’s two latest additions, ULTA and HEI.

Is ULTA a Good Stock to Buy?

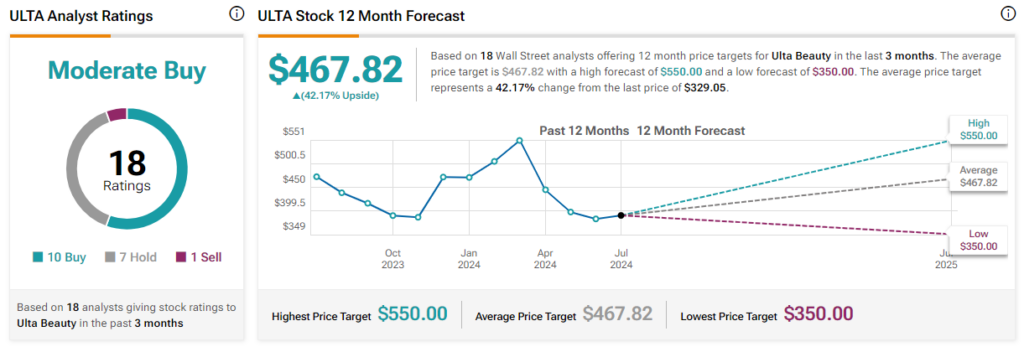

Overall, ULTA has a Moderate Buy consensus rating on TipRanks. This is based on 10 Buy, seven Hold, and one Sell recommendations. Analysts’ average price target on Ulta Beauty stock is $467.82, implying a 42.17% upside potential from current levels. The stock declined 38% in the past six months.

What Is the Price Target for HEI Stock?

On TipRanks, HEI has a Strong Buy consensus rating based on nine Buys and two Holds assigned by analysts in the past three months. After a 22.1% gain in share price in the past six months, the analysts’ average price target on Heico stock of $239.64 implies 1.16% upside potential.