Technology mutual funds can be a good way to invest in the technology sector, which has historically been known for its high-growth prospects. Investors with a long-term investment horizon could consider – BSTSX and FSPTX – two tech-focused mutual funds with over 10% upside potential in the next year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Let’s take a deeper look at the two funds.

BlackRock Technology Opportunities Fund Service Shares (BSTSX)

The FSKAX mutual fund provides exposure to stocks with rapid and sustainable growth potential from the development, advancement, and use of technology. This fund is managed by BlackRock (BLK), an investment management company. As of today’s date, BSTSX has 65 holdings with total assets of over $4.72 billion. Also, BSTSX has generated a return of 56% over the past year.

Overall, BSTSX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the total stocks held, 55 have Buys, and 10 have a Hold rating. The average price target of $72.64 implies a 21.6% upside potential from the current levels.

Fidelity Select Technology (FSPTX)

The FSPTX fund invests at least 80% of its assets in the stocks of technology companies. The FSPTX fund has 46 holdings with total assets of $11.99 billion. The FSPTX fund has returned about 59% in the past year.

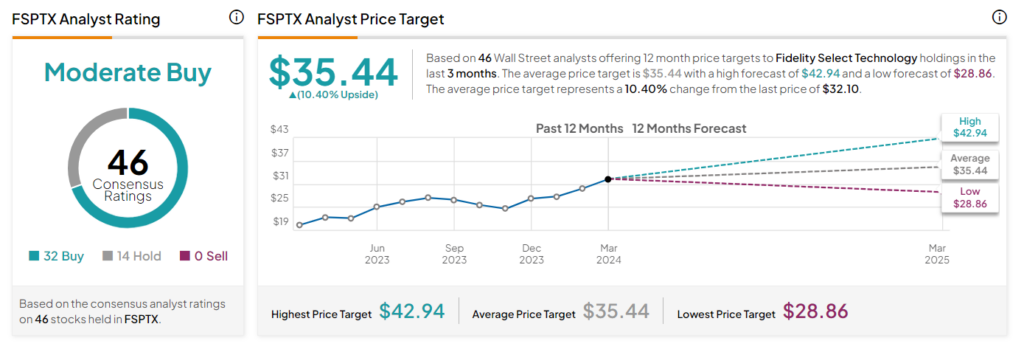

On TipRanks, FSPTX has a Moderate Buy consensus rating. This is based on 32 stocks with a Buy rating and 14 stocks with a Hold rating. The average price target on the FSPTX fund of $35.44 implies about 10.4% upside potential from the current levels.

Concluding Note

It is worth noting that mutual fund investments have several benefits, such as diversification, higher liquidity, and low minimum investment requirements. However, a prudent approach necessitates in-depth research before investing.