Normally, when an analyst cuts a price target, it is similar to a vote of no confidence. When several of them cut that target at about the same time, that is a wake-up call. But for BRP (TSE:DOO), the parent company of Ski-Doo, which also makes the Sea-Doo line of personal watercraft, it was a call to arms. Indeed, shares of BRP surged in Wednesday morning’s trading despite the analyst cuts.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

Yahoo Finance noted that “at least five different Bay Street analysts” cut BRP price targets, declaring it a former pandemic darling who lost plenty of momentum. It did not help matters that BRP cut its full-year earnings forecast for the second time in as many quarters last week after bringing out its latest set of financial results.

Among the analysts issuing cuts was Cameron Doerksen with National Bank. Doerksen noted that the BRP warnings were likely “…much more significant than anticipated.” This, in turn, led him to cut his forecast from $100 per share to $89. In addition, analyst Sabahat Khan with RBC Capital Markets cut his target from $108 per share to $99. And several others followed suit for mostly the same reasons as Doerksen gave in his note to investors.

A New Play in the Works

While BRP is certainly seeing cuts in sales as people reprioritize their shopping to reflect the surging price of necessities, it is also making some key changes to its product line, likely in the hope of spurring new interest.

One of the biggest changes comes to the MXZ-600RS Snocross Racer. It was already a top-notch vehicle, with a 70% win rate in the International Series of Champions (ISOC) Snocross circuit so far this year. But it will be getting new upgrades as well to help further ensure its dominance in the field. Reports note that the MXZ-600RS will now boast an improved coil mount and better frame reinforcement. New rear-to-center coupling with the rMotion RS rear suspension system and an “eccentric limiter strap adjuster” look to make a top performer even better.

Is BRP a Good Stock?

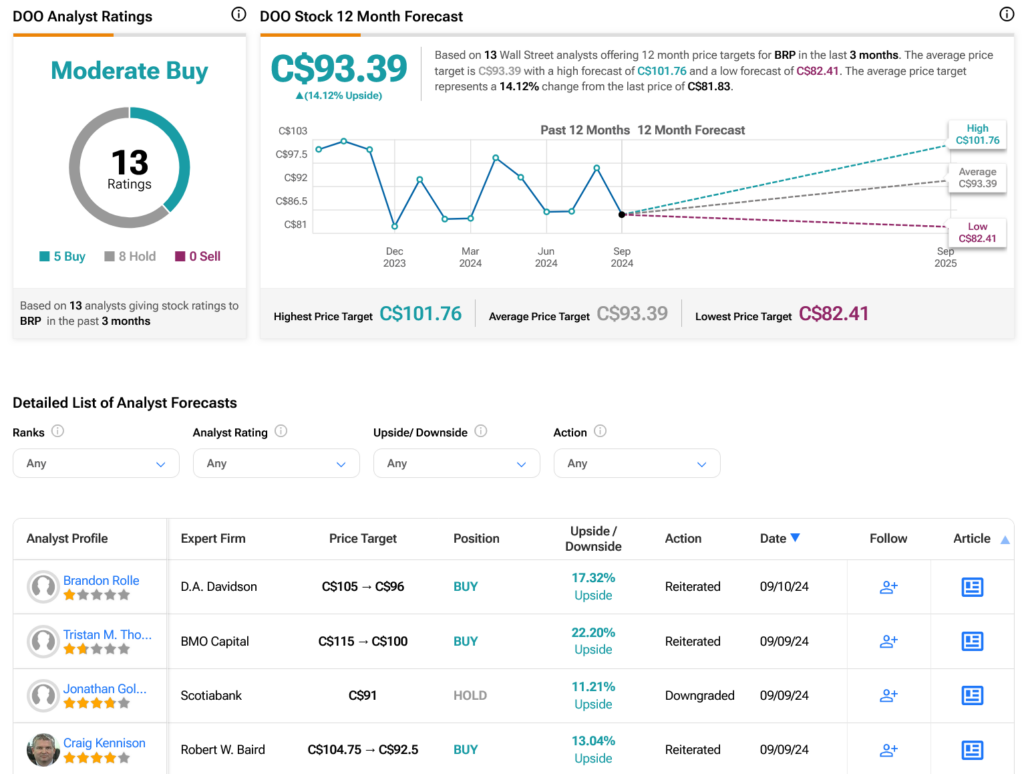

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:DOO stock based on five Buys and eight Holds assigned in the past three months, as indicated by the graphic below. After a 19% loss in its share price over the past year, the average TSE:DOO price target of C$93.39 per share implies 14.12% upside potential.