Shares of British American Tobacco (BTI) slipped in today’s trading as investors await the cigarette manufacturer’s H1 earnings results on July 25 before the market opens. Analysts are expecting earnings per share to come in at $2.19, which represents a decline from the $2.35 per share seen in the year-ago period, according to TipRanks’ data.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Despite the expected year-over-year decrease, EPS would still be able to cover the company’s current dividend. Indeed, BTI pays a quarterly dividend of $0.73 per share that equates to an 8.71% yield when annualized. Interestingly, this seems to be the midpoint of the dividend yield range since 2017, which suggests that the stock is relatively undervalued at the moment.

What Do Options Traders Anticipate?

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you. Indeed, it currently says that options traders are expecting a large 4.76% move in either direction.

Is BTI Stock a Buy or Sell?

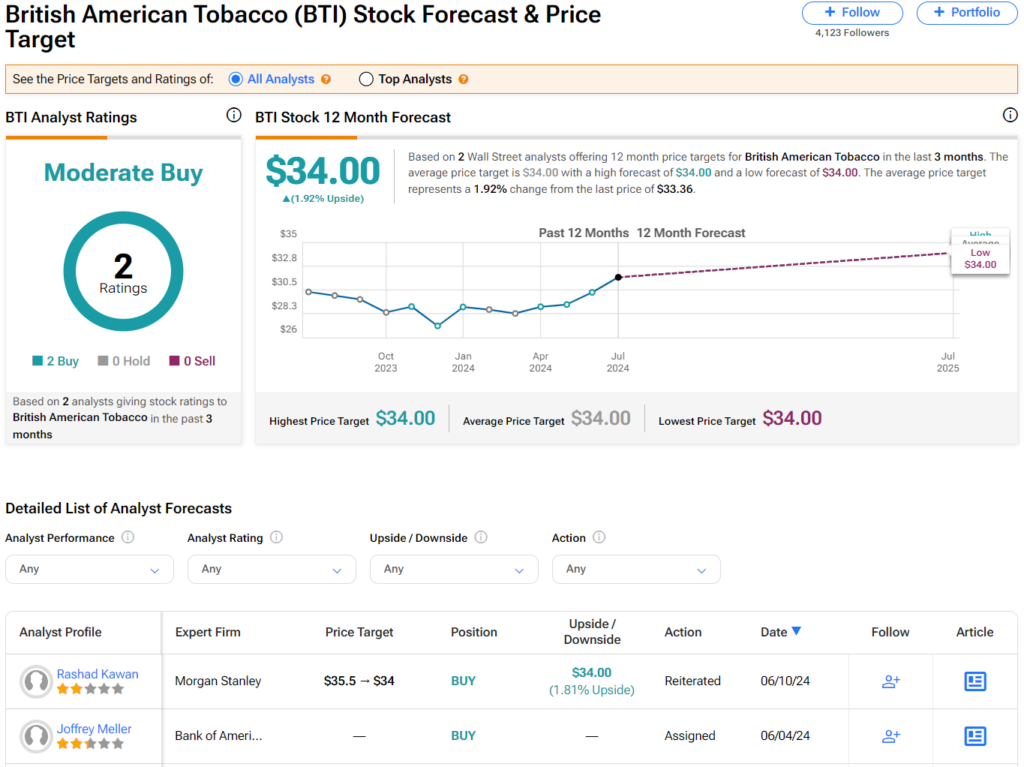

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BTI stock based on two Buys assigned in the past three months. After an 8% rally in its share price over the past year, the average BTI price target of $34 per share implies 1.92% upside potential.