Intel’s (NASDAQ:INTC) dominance in the PC market has sharply declined. Once the unchallenged leader of personal computing, Intel’s late entry into the AI race has left it scrambling to catch up with faster-moving competitors.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

While tech rivals have enjoyed skyrocketing stock prices in 2024, Intel has been struggling, with its shares plummeting by more than half this year alone.

Beyond a failure to identify the potential of the AI revolution, Intel has been rapidly losing market share for the x86 CPUs it manufactures for PCs and servers. Over the past six years, its market dominance has dropped from 82.2% to 62.8%.

Its foundry business is also slipping, with operating losses increasing by over 25% year-over-year to -$5.3 billion in the first half of 2024.

In response to these challenges, Intel has initiated a restructuring effort in an attempt to course-correct. The company has suspended its dividend, cut 15,000 jobs, and is reportedly considering selling its foundry division.

However, investor Bashar Issa remains skeptical, doubting whether these measures will be sufficient to restore the Silicon Valley giant to its former glory.

“The company missed its opportunity to monetize the AI trends that are benefiting its competitors,” writes the investor.

Moreover, Issa questions the very premise of CEO Pat Gelsinger’s attempts to attract business from fabless semiconductor companies.

“Whatever he does, fabless customers won’t come, at least not those competing with Intel, which is effectively every semiconductor company except perhaps those designing memory chips, the least lucrative of all microchips,” Issa opined.

Issa argues that these efforts have distracted Intel from its true north of PC CPU brands, which have provided the majority of the company’s revenues for decades.

“This restructuring noise is particularly concerning as the market moves toward the next generation of AI-powered laptops/desktop CPUs, a pivotal transition that opens a rare opportunity for Intel to reclaim its throne in the market,” Issa noted.

All these blunders have been creating a poor reputation for Intel among the next generation, writes the investor, who details the strategic threat of university students learning to work with the technology of Nvidia and ARM, instead of with Intel’s.

“Intel has the uncertainty of a startup and the bureaucratic weight of a blue-chip company, with the benefits of neither,” Issa concludes, rating Intel shares a Sell. (To watch Issa’s track record, click here)

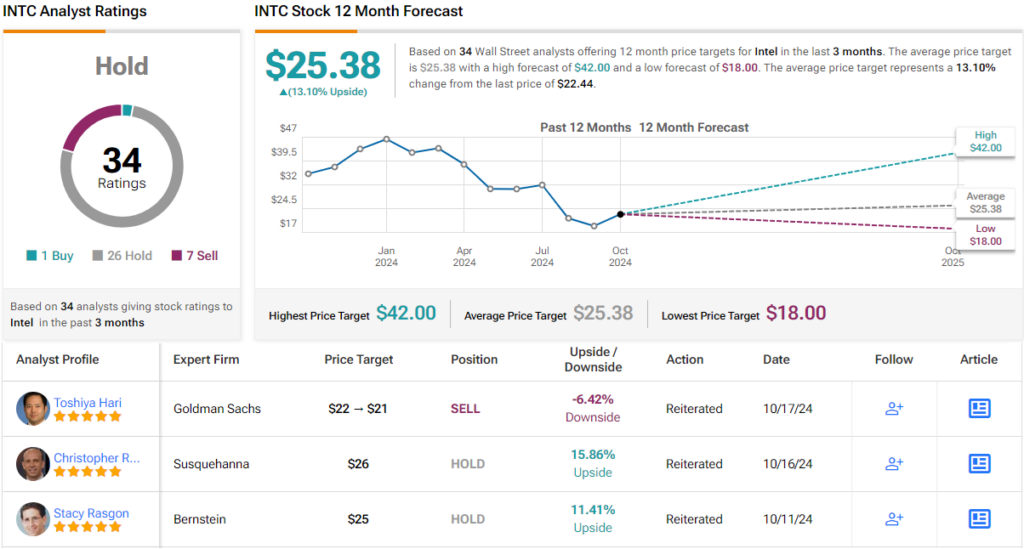

Meanwhile, while Wall Street analysts aren’t as bearish as Issa, they remain cautious. With 1 Buy, 26 Hold, and 7 Sell ratings, Intel currently holds a consensus rating of Hold (i.e. Neutral). Its average 12-month price target of $25.38 suggests a potential upside of 13%. (See Intel stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.