Boeing (BA) CEO Kelly Ortberg is considering selling off the company’s space exploration business. The Wall Street Journal reports that the new leader is exploring the possibility of taking Boeing out of the space race entirely. Given the company’s history of working with NASA and helping launch vehicles into space, this may seem like an extreme measure. However, after a year of persistent struggles, Boeing needs a turnaround if it is going to be saved.

What’s Happening with Boeing Stock Today

Boeing isn’t off to a good start this week, though this likely doesn’t have much to do with the potential space business sale. The company recently issued a new stock offering in a clear attempt to generate a cash influx. As expected, this news has sent BA stock down, continuing the downward trend it has been on for the past three months.

With BA stock down 40% year-to-date (YTD), Ortberg is facing an uphill battle. But he seems focused on making the changes necessary to turn things around. The good news is that selling off Boeing’s space exploration business likely won’t be difficult. It’s products and services includes the CST-100 Starliner and X-37B spacecrafts as well as a family of satellites.

According to unnamed Wall Street Journal sources, prior to Ortberg’s appointment, Boeing had discussed the possibility of Jeff Bezos’ Blue Origin “over some of the NASA programs.” The privately held company has launched several missions over the past year and could be a likely buyer. No other context has been provided as to who else may try to buy Boeing’s space division.

Is BA Stock a Buy, Sell or Hold?

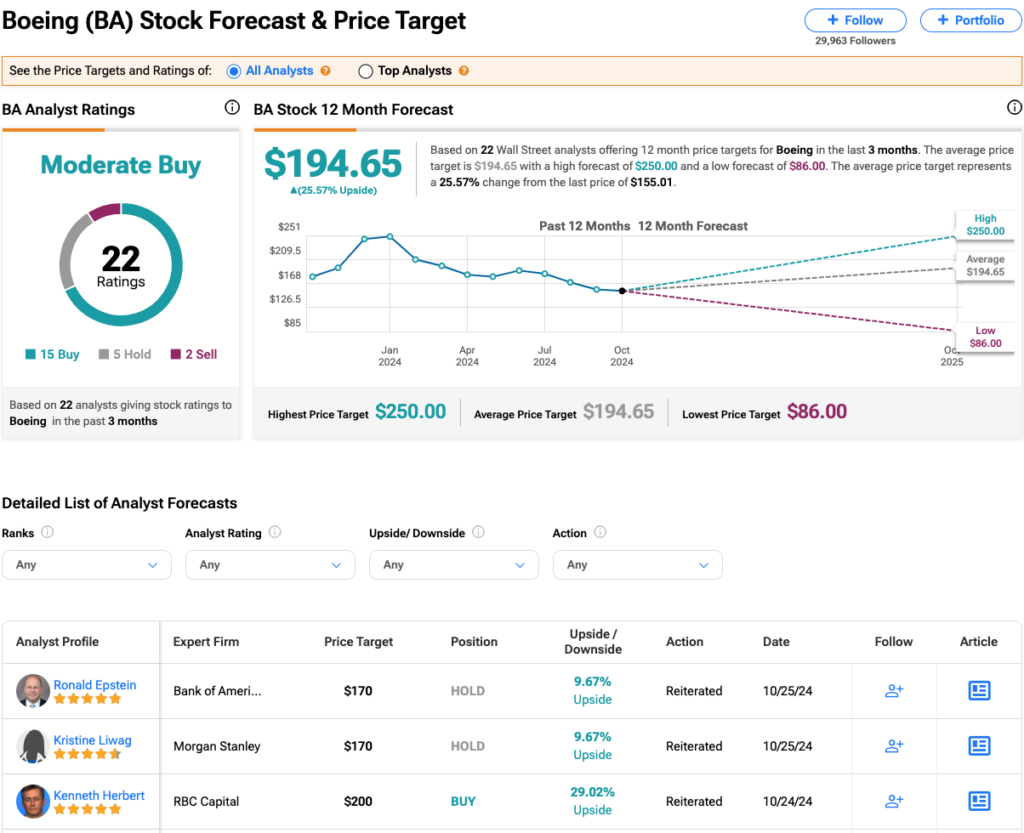

Despite’s its recent performance, Wall Street remains mostly bullish on Boeing. Analysts maintain a Moderate Buy consensus rating on BA stock based on 15 Buys, five Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After shares declined 15% over the past year, the average BA price target of $194 per share represents a 25.57% change from the last price of $155.

The two most recent takes from Wall Street have been measured Hold ratings. Bank of American (BAC) analyst Ronald Epstein, who is highly bullish on several other aerospace stocks, rates it as a Hold “due to a combination of factors surrounding Boeing’s financial performance and strategic outlook.” However, both analysts’ price targets still imply 10% upside potential.