BlackBerry Ltd. (NYSE: BB) has delivered upbeat fiscal fourth-quarter results on both earnings and revenue fronts. However, shares of the company lost 3.8% during the extended trading session on Thursday, perhaps due to its flat revenue guidance.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

BlackBerry engages in the provision of enterprise software and services, which focuses on securing and managing Internet of Things endpoints.

Results in Detail

BlackBerry reported adjusted earnings of $0.01, above analysts’ expectations of a loss of $0.07 per share. However, the figure declined 50% from the same quarter last year.

Revenues tanked 11.9% year-over-year to $185 million but exceeded consensus estimates of $177.3 million. Similarly, gross margin also declined to 67%, compared to 72.4% in the year-ago period.

For Fiscal Year 2022, Blackberry reported revenues of $718 million, down 19.6% year over year. Also, it reported an adjusted loss of $0.10 for the year.

Segment Details

Despite global supply constraints, IoT business revenues grew 37% year-over-year to $52 million; Cyber Security revenue remained flat at $122 million; and Licensing & other revenues declined 78% to $11 million during the quarter.

CEO’s Take

The CEO of BlackBerry, John Chen, said, “We’re also excited about the prospects for the Cybersecurity business given another quarter of billings growth and further strengthening of the team with industry expertise in both sales and product development. The key components are in place, and we expect continued billings momentum this year.”

Outlook

Blackberry expects to see minimal licensing revenue, while cyber business billings are projected to grow 8% to 12%. Overall, revenues for the Fiscal Year 2023 are expected to remain flat.

Further, Blackberry anticipates strong growth for its IoT business despite auto industry-related hurdles. Revenues for the year are expected between $200 million and $210 million, up 12% to 18% year-over-year.

Stock Rating

Overall, the stock commands a Hold consensus rating based on one Buy, one Hold and two Sells. BlackBerry’s average price target of $6.88 implies 7.8% downside potential to current levels.

Website Traffic

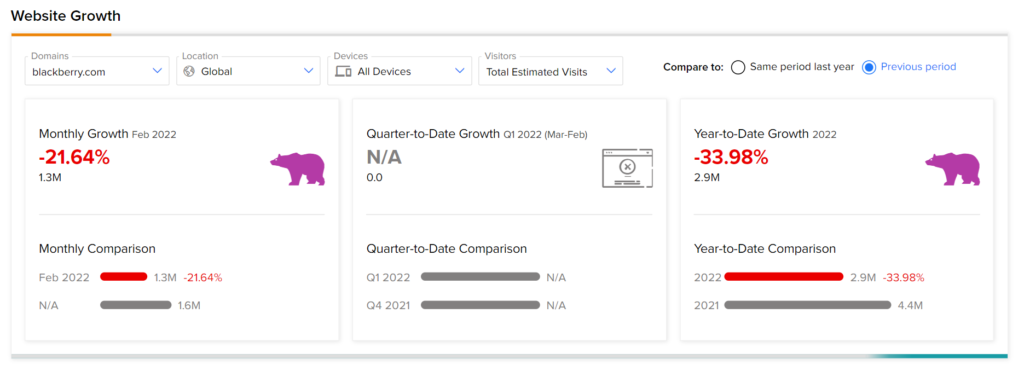

TipRanks’ Website Traffic tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into BB’s performance.

According to the tool, the Blackberry website recorded a 21.6% monthly decrease in global visits in February, compared to the previous year. Likewise, the footfall on its website has declined 34% year-to-date against the same period last year.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Teva Gains 6.4% on Another Opioid Case Settlement

Hackers Fool Two Tech Giants; Will Regulators Intervene?

Analysts Bullish on Gildan Despite Volatile Performance