Shares of BJ’s Wholesale Club (NYSE:BJ) hit a new 52-week high of $78.97 on Thursday and ended the day up by 9.3%. The upside comes after the company reported better-than-expected earnings for the fourth quarter on higher revenues. Furthermore, BJ’s plans to open 12 new clubs and 15 additional gas stations in the current year might have fueled optimism among investors.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

BJ’s Wholesale is a membership-based warehouse club chain offering groceries, household essentials, and other merchandise at discounted prices.

Q4 Financial Highlights

BJ posted adjusted earnings of $1.11 per share, up 11% compared to the prior-year quarter, and surpassed the analysts’ estimates of $1.06 per share. Meanwhile, revenue increased 8.7% year-over-year to $5.36 billion but came below analyst estimates of $5.38 billion.

It is worth mentioning that the company witnessed a 6.5% growth in membership fees and achieved a member renewal rate of 90% during Fiscal 2023.

2024 Outlook

For Fiscal 2024, BJ’s expects adjusted earnings in the range of $3.75 to $4 per share, compared with analyst expectations of $4. Further, the company anticipates that comparable club sales, excluding gasoline sales, will increase between 1% and 2% year-over-year. Analysts expect same-store sales to increase by 1.6%.

Is BJ Stock a Buy?

Following the release of Q4 earnings, Jefferies analyst Stephanie Wissink maintained a Buy rating on the stock and raised the price target to $90 from $80.

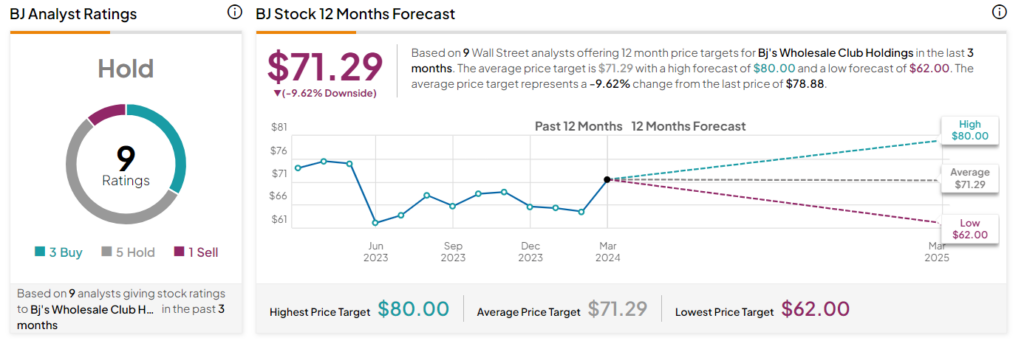

Overall, analysts remain sidelined on BJ stock, with a Hold consensus rating based on three Buys, five Holds, and one Sell. After a 20% rally in share price over the past three months, the average BJ price target of $71.29 implies a downside potential of 9.6% from current levels.