Bitcoin (BTC-USD) has recently been on a bumpy ride, as some analysts are raising alarms over key trading patterns, while others remain optimistic about its long-term potential. Veteran trader Peter Brandt’s analysis, combined with other traders’ insights, sheds light on what might be next for the world’s most popular cryptocurrency.

Peter Brandt Warns of the “Three Blind Mice” Pattern

According to veteran trader Peter Brandt, Bitcoin is showing signs of forming the “Three Blind Mice” trading pattern. This pattern, while not widely discussed, is seen by some traders as a signal that Bitcoin’s current downtrend may persist. Brandt shared his observations on X (formerly Twitter) on Oct. 2, noting that Bitcoin is in a downtrend, marked by lower highs and lower lows over the last seven months. His warning came with a specific condition: “Only a close above 71,000 confirmed by a new ATH will indicate that the trend from the Nov 2022 low remains in force,” Brandt explained.

The idea of the “Three Blind Mice” may sound playful, but the consequences could be serious for traders hoping for a bullish turnaround in the near term. Historical data suggests that this pattern could lead to a continuation of the downward trend, similar to what occurred in late 2022 when Bitcoin struggled around $17,000 before a sharp rise in early 2023. Brandt’s analysis comes from his X posts and technical data from Morpher.

Bitcoin’s Bullish Sentiment Persists Despite Market Dip

Despite Brandt’s warning, not all traders are hitting the panic button. Another well-known trader, Rekt Capital, remains confident in Bitcoin’s bullish market structure. While acknowledging Bitcoin’s drop to around $60,000, he emphasizes that this is nothing new for the market. In a recent X post, Rekt Capital noted that “BTC has revisited the low $60,000s countless times over the past several months” and stressed that the market structure remains intact.

The upbeat tone from some traders is echoed by Jelle, who advised followers not to be shaken by the temporary pullback. He argued that Bitcoin’s support levels are still holding strong, even as the market deals with geopolitical tensions and economic uncertainties.

Traders Suggest a “Buy the Dip” Opportunity for Bitcoin

In the midst of these contrasting outlooks, data analysts like Checkmate are pointing to potential buying opportunities. Analyzing the short-term holder spent output profit ratio (STH-SOPR), Checkmate observed that Bitcoin’s recent dip could signal a good time to “stack the cheapest sats.” This metric essentially tracks the profits that short-term Bitcoin holders are taking, and with the STH-SOPR dipping below 1.0, it suggests that selling pressure is easing, offering a possible entry point for investors.

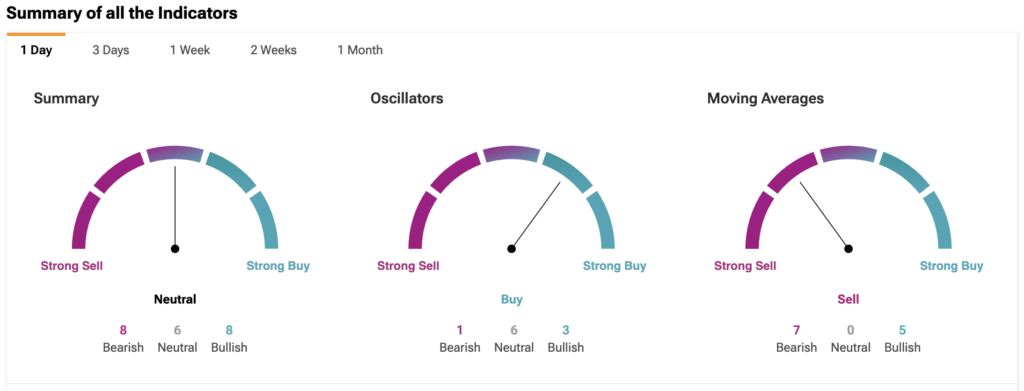

Adding to the complexity of the current market sentiment, TipRanks’ Bitcoin Technical Analysis tool reflects the confusion among traders. As shown in the summary, the overall sentiment is Neutral, with equal measures of bearish and bullish forces at play. While oscillators indicate a “Buy” sentiment, moving averages signal a “Sell.” Some traders view the recent dip as a potential buying opportunity, while others remain cautious. The saying “fortune favors the bold” might come to mind here, though whether it applies in this case is still uncertain.