Renowned German shoemaker Birkenstock (BIRK) has made impressive strides since its initial public offering last fall. The company reported record-breaking revenue for the third quarter of fiscal 2024, soaring 16% year-over-year. Despite this, Q3 results fell short of analysts’ expectations, prompting the stock to fall 20% in the past month. However, the sell-off may be overdone, as the company’s upward revenue trajectory is expected to continue as Birkenstock expands its customer base across Europe, the U.S., and the crucial Chinese market, making this a potential buy-on-the-dip opportunity.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Birkenstock Boasts Healthy Growth

Birkenstock boasts a diverse global presence, offering a broad unisex portfolio of footbed-based products. In addition to its iconic footwear, Birkenstock has also ventured into skincare and accessory products.

The company operates through two main sales channels: business-to-business (B2B) and direct-to-consumer (DTC). The B2B channel includes sales made to established third-party store networks, while the DTC channel comprises sales made via the company’s globally owned online stores and retail establishments.

B2B revenue has significantly increased due to high wholesale demand and successful sell-through, mainly due to existing door expansions from key retail partners increasing their Birkenstock offerings in response to rising consumer demand. DTC revenue has also shown healthy double-digit growth annually over the past three years.

Birkenstock’s Recent Financial Results & Outlook

The company has recently reported results for Q3 of FY2024, posting revenue of $608.2 million and demonstrating a 16% year-over-year increase. This growth resulted from increased consumer demand for closed-toe silhouettes, which grew more than twice the brand’s average. The company also expanded geographically, opening seven new stores, and saw a 23% year-over-year growth in B2B revenue, with 90% of this growth coming from existing retailers.

However, revenue fell short of analysts’ estimates of $631.7 million. While adjusted EBITDA rose by 15%, the adjusted EBITDA margin fell by 140 basis points year-over-year to 34.4%. Earnings per share of $0.54 marked 11% year-over-year growth yet missed analysts’ expectations of $0.57.

Following its promising, although mixed third-quarter results, BIRK’s management has issued guidance for the fiscal year 2024, forecasting revenue growth of around 19%. Adjusted EBITDA margin is projected to be between 30-30.5%. Additionally, in the medium to long term, it anticipates a gross profit margin of about 60% and an Adjusted EBITDA margin of over 30%.

What Is the Price Target for BIRK Stock?

BIRK stock has climbed over 18% since the company went public last October. However, after the recent decline in price, it trades near the middle of its 52-week price range of $35.83 – $64.78 and shows negative price momentum by trading below its 20-day (54.94) and 50-day (55.87) moving averages.

Analysts following the company have been bullish on BIRK stock, even as they have adjusted price targets downward. For example, Evercore ISI analyst Michael Binetti recently reiterated an Outperform rating on the shares while lowering the price target from $77 to $70, noting the company’s demand/brand growth story is not “off track at all.”

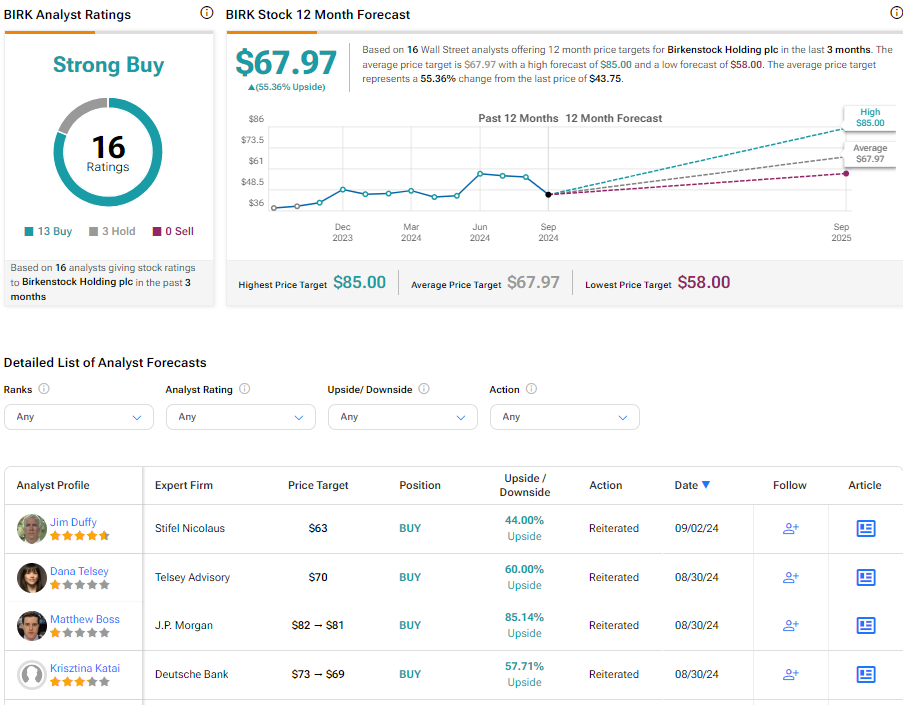

Based on 16 analysts’ recent recommendations and price targets, Birkenstock is rated a Strong Buy. The average price target for BIRK stock is $67.97, representing a potential upside of 55.36% from current levels.

Bottom Line on BIRK

Despite falling short of Q3 estimates and experiencing a subsequent 20% drop in stock price, iconic shoemaker Birkenstock’s sturdy financial performance and strategic expansion plans remain encouraging. The German shoemaker has demonstrated impressive double-digit growth in its B2B and DTC channels. Expanding into new markets and growing consumer demand for its diversified product range suggests a robust financial outlook. As Birkenstock continues its growth trajectory, current market conditions may present a ripe buy-on-the-dip opportunity for investors.