Biotechnology company BioNTech SE (NASDAQ: BNTX) recently revealed that it has joined hands with a fellow biotechnology company, Matinas BioPharma, to evaluate the combination of mRNA formats and Matinas’ proprietary LNC platform technology.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Following the news, shares of the company rose marginally on Monday. The stock pared its gains completely and declined 2.5% to close at $166.28 in the extended trading session.

The collaboration will leverage BioNTech’s expertise in mRNA vaccine development and Matinas’ proprietary LNC platform technology to advance novel formulations for mRNA vaccines, including a potential formulation for oral vaccines.

Under the terms of the agreement, Matinas will receive an upfront access fee to work exclusively with BioNTech as well as additional research funding from BioNTech. Further, the parties have commenced discussions to have a license agreement in place for Matinas’ LNC platform technology.

Management Commentary

The CEO of BioNTech, Ugur Sahin, M.D., said, “Accomplishing strong immune responses with low doses are crucial in the development of well-tolerated and highly effective vaccines. This can be achieved with the right technology that enables targeted vaccine delivery. Matinas’ LNC platform demonstrates encouraging capabilities for intracellular delivery, including the opportunity for oral delivery. We are excited to collaborate with this extraordinary team of experts.”

Stock Rating

Recently, Canaccord Genuity analyst Arlinda Lee reiterated a Buy rating on the stock. The analyst, however, lowered the price target from $450 to $300, which implies upside potential of 75.9% from current levels.

According to the analyst, BioNTech’s heightened revenue visibility from its vaccines combined with its diversified immunotherapy pipeline gives it a strong footing. However, the company’s efforts to democratize novel medicine access can hurt its top line.

The Wall Street community is cautiously optimistic about the stock and has a Moderate Buy consensus rating based on three Buys and eight Holds. BioNTech’s average price target of $249.90 implies that the stock has upside potential of 46.5% from current levels. Shares have gained 40.4% over the past year.

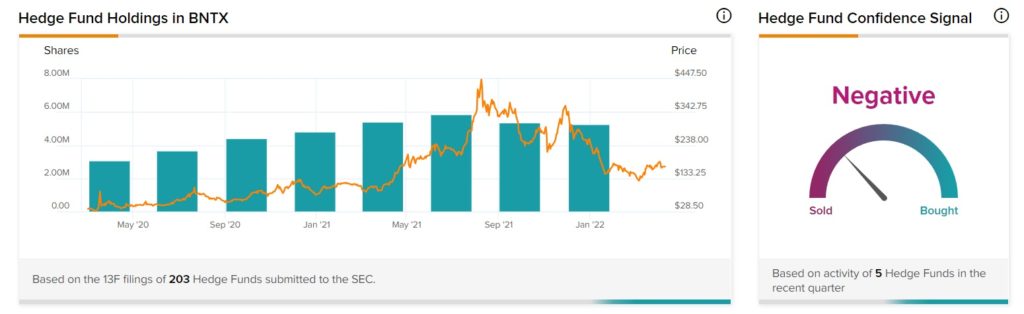

Hedge Funds’ Confidence

TipRanks’ Hedge Fund Trading Activity tool shows that hedge fund confidence in BioNTech is currently Negative. Moreover, the cumulative change in holdings across the five hedge funds that were active in the last quarter was a decrease of 110,000 shares.

Conclusion

The efficient and effective administration of vaccines can go a long way in ensuring the timely treatment of diseases. To that end, BioNTech’s collaboration with Matinas is likely to be a successful one, taking into account the strengths of both companies in their respective fields.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure

Related News:

Moderna Recalls 764,900 COVID-19 Doses in Europe

JetBlue Trims Flight Schedules

Goldman Strengthens Asset Management Business