Bill Ackman’s Pershing Square Capital made significant moves from June to September. Most notably, Ackman increased his stakes in Nike (NKE) and Brookfield (BBU) fivefold. Ackman, a billionaire hedge fund manager who turned $26 million into $2.6 billion during the COVID-19 market crash, runs a focused portfolio with fewer than 10 positions and $13 billion in assets. During the third quarter, the portfolio’s total value grew by 24%.

Brookfield became Ackman’s second-largest holding at 33 million shares worth $1.7 billion – 13% of Pershing Square’s assets. Brookfield shares gained nearly 30% in the quarter and another 9% since September. A key catalyst for Brookfield is its planned conversion of a private BAM stake into publicly traded shares in early 2025, which should lead to it being included in U.S. stock indices.

Ackman also increased his Nike position by 440% to 16 million shares, which are valued at $1.4 billion, though Nike stock has dropped 14% since September. In addition, he trimmed his Hilton (HLT) stake by 18% in order to take profits but maintained large positions in Chipotle (CMG), Restaurant Brands (QSR), and Alphabet (GOOGL), which remains Pershing Square’s largest holding at $1.8 billion.

Bill Ackman Is Positive about the Economy

Separately, Bill Ackman recently praised President-elect Donald Trump for appointing Elon Musk and Vivek Ramaswamy to co-lead the Department of Government Efficiency (DOGE), which aims to cut government spending. Ackman described the pair as a “dream team” in an interview with SiriusXM host Megyn Kelly. He also believes that tax cuts will lead to a massive boom in the economy, along with more hiring.

Is Nike Stock a Buy, Sell, or Hold?

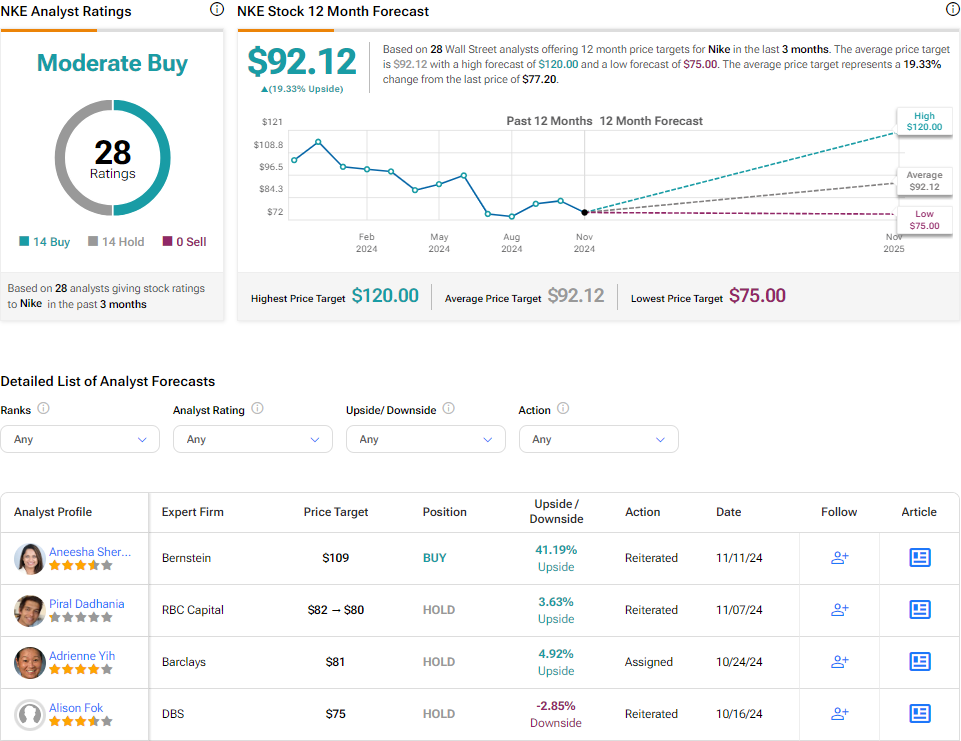

Turning to Wall Street, analysts have a Moderate Buy consensus rating on NKE stock based on 14 Buys, 14 Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 50% rally in its share price over the past year, the average NKE price target of $92.12 per share implies 19.3% upside potential.