In this article, I will analyze three oil giants with the help of the TipRanks Stock Comparison Tool. The 3 companies are UK-based BP p.l.c. (BP) along with Chevron (CVX) and Exxon Mobil (XOM) which are both based in the United States. While I am bullish on all three as solid picks for income-focused investors, I view Exxon Mobil as the slightly better choice for long-term robust dividend payments, even though it currently offers the lowest dividend yield. Let’s dive deeper into the details.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

A Closer Look at Chevron (CVX)

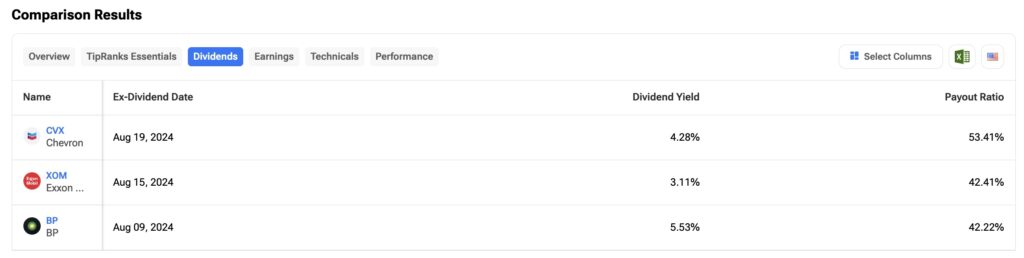

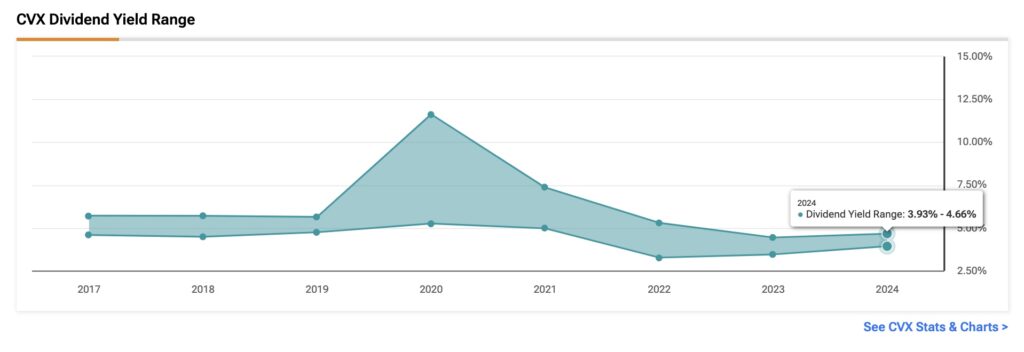

I have a bullish view on CVX, and see it as one of the preferred oil stocks for dividend investors, offering stability in a highly cyclical industry. Currently, Chevron boasts a dividend yield of 4.3% (at a 53% payout), which exceeds the 10-year Treasury yield on the strength of its robust cash flow.

Chevron’s appeal lies in its strong free cash flow margin of nearly 9.45% over the past twelve months, which demonstrates efficient revenue conversion. Its disciplined capital expenditure (capex) approach, reflected by a CAPEX/Sales ratio of 8.7% (well below the industry average of 15%) is complemented by a low debt-to-equity ratio of 14.4%. These characteristics further support my view that the company’s dividends and buybacks are sustainable. In the past year, Chevron has repurchased $12.5 billion in shares, resulting in a buyback yield of about 4.5% based on a market capitalization of approximately $278 billion.

Regarding growth prospects, future earnings growth is expected to be weak. Analysts actually forecast an 18.1% earnings decline to $10.75 per share in today’s oil price environment. Given the inherent volatility of the oil industry, long-term estimates can be less reliable. Despite these projections, Chevron trades at a forward P/E ratio of about 14x for the full-year 2024.

Is CVX a Buy, Hold, or Sell?

At TipRanks, 14 ratings from Wall Street analysts lead to a Moderate Buy consensus. This is based on nine Buy ratings and five Hold ratings. The average price CVX price target of $172.62 suggests a potential upside of ~14%.

A Closer Look at Exxon Mobil (XOM)

Regarding Exxon Mobil, I hold a positive outlook, similar to for Chevron. As a robust income stock, Exxon Mobil currently offers a dividend yield of 3.2% (at a 41% payout), which is lower than Chevron’s.

Exxon Mobil’s standout feature is its exceptional cash generation, with a free cash flow margin of 18.35% over the past twelve months—nearly double that of Chevron. This strong margin provides ample liquidity for supporting dividends and buybacks in the coming years. With a debt-to-equity ratio of 15.6%, Exxon Mobil maintains low leverage and a safe balance sheet for returning capital to shareholders. Its CAPEX/Sales ratio of 6.5% indicates a moderate level of investment in assets relative to sales, occurring particularly in high-growth upstream operations like Guyana and the Permian Basin.

Over the past twelve months, Exxon has repurchased approximately $17.4 billion in shares, resulting in a buyback yield of 3.16% based on its current market capitalization of ~$551 billion.

As it pertains to growth, analysts project a 14.8% decline in earnings for FY2024 and estimate an EPS of $8.11. This reflects a less-than-ideal oil price environment, similar to the low expectations for Chevron. Despite these projections, Exxon Mobil trades at a forward P/E ratio of ~15x, which is slightly higher than Chevron’s. This premium may be justified, however, especially given Exxon’s more robust free cash flow margins.

Is XOM a Buy, Hold, or Sell?

According to the Wall Street consensus reported by TipRanks, Exxon Mobil is rated as a Moderate Buy. Out of 16 analysts, 11 have issued Buy ratings, while five have rated the stock as a Hold. The average XOM price target is $137.13, suggesting an upside potential of about 11%.

A Look at London-Based BP

BP, which commands a market capitalization under $100 billion, is much smaller than its American peers. I’m pleased by BP’s dividend, as the stock currently offers the highest dividend yield among the three oil giants at about 5.5%, with a payout ratio of 42.2%.

BP has achieved a free cash flow margin of 8.3% over the past twelve months, demonstrating a solid capacity to return capital to shareholders despite this margin being lower than the one’s posted by Chevron and especially Exxon Mobil. In the past year, BP has repurchased approximately $6.9 billion in shares, resulting in a buyback yield of 8% based on a market cap of $86.58 billion, significantly higher than that of Chevron and Exxon Mobil. However, BP’s strategy relies on elevated oil prices, prioritizing growth and shareholder returns over debt repayment.

A key concern is BP’s high debt, reflected by a debt-to-equity ratio of nearly 80%. This situation is linked by past challenges, such as the 2010 Gulf of Mexico disaster, as well as substantial investments in renewable energy. Nevertheless, it’s worth noting that its CAPEX-to-sales ratio over the past twelve months is a manageable 7.45%.

For 2024, BP’s earnings per share (EPS) are projected to come it at $3.89, which would be an 18.7% decline. This leads to a forward P/E ratio of about 8.2x, nearly half that of Exxon Mobil and well below the valuation multiple for Chevron. BP’s higher debt profile is a concern, and its significant commitment to transitioning to renewable energy—aiming for net zero by 2050—introduces uncertainty about future cash flows.

Is BP a Buy, Hold, or Sell?

At TipRanks, the consensus rating for BP is a Moderate Buy. Out of 8 analysts, three have a Buy rating, while five recommend holding the stock. The average price BP target is $42.36 which is well above the recent market price. Analysts, on average, expect BP shares to rise more than 30%.

Conclusion

While BP stands out for income generation with the highest dividend and buyback yields, the company has elevated debt levels. Exxon Mobil emerges as the best investment among the three oil giants, in my personal opinion. I think XOM stock is appealing for risk-averse investors seeking safe and stable dividends amid industry volatility, backed by the company’s robust free cash flow margin. CVX stock is also attractive, offering a balanced option with reliable dividends and cash flow generation. However, Chevron has a much lower free cash flow yield.

While I am bullish on all 3 oil stocks, my favorite is XOM.