It is, admittedly, hard to think about the holiday shopping season right now, being as it’s still about three months out, depending on when you get started. Granted, you might see holiday decorations up as soon as Labor Day in some places, but still. Anyway, retailer Best Buy (BBY) was identified as a potential holiday winner by Jefferies, but shareholders thought otherwise, and it lost nearly 3% in the final minutes of Monday’s trading.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Analyst Jonathan Matuszewski believes that Best Buy stands to land some significant business with the holiday shopping season thanks to one key point: the laptop refresh cycle. Granted, shoppers’ budgets are pretty well constrained right now. But that means that shoppers are paying a lot closer attention to value. After all, with the Windows 10 operating system about to lose support and the rise of AI laptops, there’s a lot more reason these days to find a new laptop.

Plus, even for those who don’t want to go all the way to AI laptops, their arrival means that stores are looking to clear shelves ahead of the new models. That, plus holiday shopping, means bargain pricing. Bargain pricing these days is a reason to shop, especially for anyone whose laptop is looking a bit long in the tooth.

Firing Up Its Sales

And Best Buy has not been shy about firing up its sales. It just concluded an end-of-summer sale geared toward the back-to-school market. A list of the lineup featured some impressive deals, including Beats headphones marked down from $199.95 to $129.95 and a Chromebook cut from $299 to $159. With product refresh cycles and a major holiday coming up, though, this may be enough to give Best Buy a solid boost

Is Best Buy Stock a Good Buy Now?

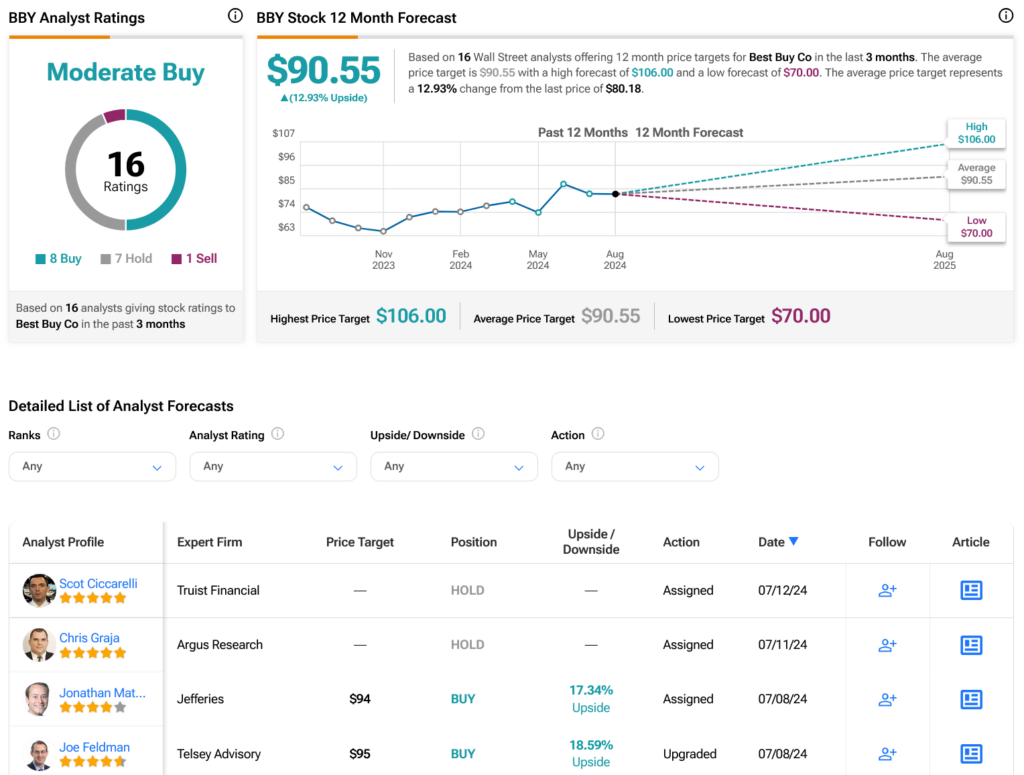

Turning to Wall Street, analysts have a Moderate Buy consensus rating on BBY stock based on eight Buys, seven Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 4.91% rally in its share price over the past year, the average BBY price target of $90.55 per share implies 12.93% upside potential.