Recording strong gains, shares of Bed Bath & Beyond Inc. (NASDAQ: BBBY) jumped over 34% to close at $21.71 a piece on Monday. The price surge followed the revelation of the large stake bought by billionaire Ryan Cohen in the housewares retailer.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Cohen, the co-founder of pet-supplies retailer Chewy, Inc. (CHWY) and chairman of GameStop Corp. (GME), purchased a 9.8% stake in the American chain of domestic merchandise retail stores through his investment firm, RC Ventures.

Additionally, in a letter sent to the retailer, based on the company’s performance and recent challenges, Cohen outlined strategic alternatives for its future transformation, which included selling the company as a whole or at least its baby-products business.

Management Comments

In response to the letter received from RC Ventures, management stated that “Bed Bath & Beyond’s Board and management team maintain a consistent dialogue with our shareholders and, while we have had no prior contact with RC Ventures, we will carefully review their letter and hope to engage constructively around the ideas they have put forth.”

The company further added, “Our Board is committed to acting in the best interests of our shareholders and regularly reviews all paths to create shareholder value. 2021 marked the first year of execution of our bold, multi-year transformation plan, which we believe will create significant long-term shareholder value.”

Wall Street’s Take

Following the disclosure of Cohen’s stake buy in BBBY, Telsey Advisory analyst Cristina Fernandez maintained a Hold rating but lifted the price target to $18 (17.09% downside potential) from $15.

Fernandez commented, “We agree with Mr. Cohen that Bed Bath & Beyond needs to improve operations and its inventory mix—an issue prior to the pandemic.” She went on to argue that the retailer’s average online delivery time is too far behind its industry peers, but praised its buybuyBABY business and its lack of real national competition.

However, the analyst does believe that “profitability is low, with an EBITDA margin in the LSD-MSD range.”

The rest of the Street is bearish on the stock with a Moderate Sell consensus rating. That’s based on one Buy, six Holds, and six Sells. The average Bed Bath & Beyond price target of $14.41 implies 33.63% downside potential. Shares have lost 29.9% over the past year.

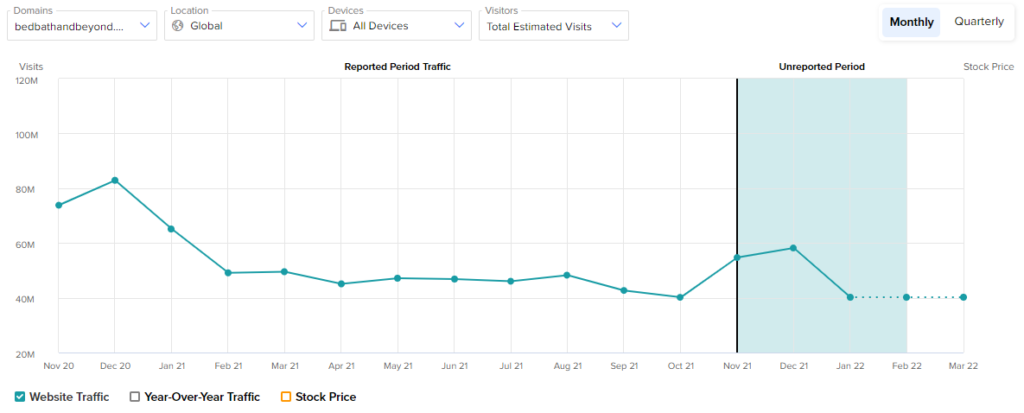

Estimated Monthly Visits

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), offers insight into Bed Bath & Beyond’s performance.

According to the tool, the BBBY website recorded a 30.94% decrease in global estimated visits in January compared to the month of December. Also, year-to-date website growth, compared to year-to-date website growth in the previous year, came in at a decline of 38.29%. This, in turn, indicates that the company’s revenues and profitability might remain in murky waters going forward.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

bluebird bio Reports Quarterly Loss, Provides Clinical Updates

Ocugen’s COVAXIN Denied by FDA for Pediatric Emergency Use; Shares Drop

Biogen & Eisai Initiate PMDA’s Process for Lecanemab in Japan