BlackBerry (NYSE:BB) surged in trading on Thursday after announcing better-than-expected Q1 revenues. The cybersecurity company’s Q1 revenues plunged by 61.4% year-over-year to $144 million but were still above consensus estimates of $138.9 million.

Furthermore, the company swung to an adjusted loss of $0.03 per share in the first quarter, compared to earnings of $0.06 in the same period last year but was in line with estimates.

BB’s Revenue Breakdown

The company’s Internet of Things (IoT) revenues went up by 18% year-over-year to $53 million, while it clocked cybersecurity revenues of $85 million. These figures exceeded the company’s previously issued guidance. The Company’s IoT business consists of BlackBerry Technology Solutions (BTS) and BlackBerry Radar.

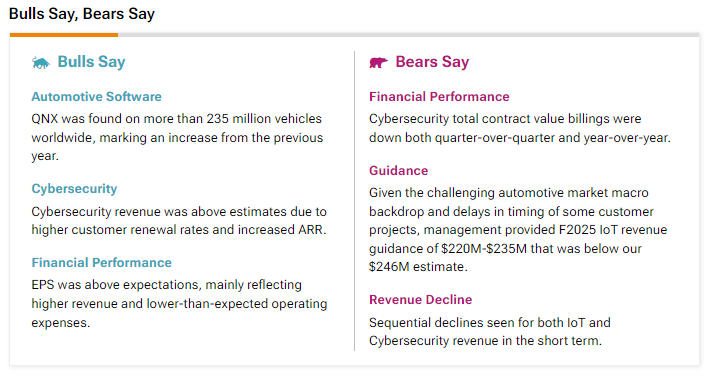

According to TipRanks “Bulls Say, Bears Say,” analysts optimistic about the stock believe that the uptick in its cybersecurity revenues was “due to higher customer renewal rates and increased ARR [annual recurring revenue].”

BB’s Outlook

In the second quarter, the company is estimating revenues in the range of $136 million to $144 million, while adjusted earnings is likely to be between a negative $0.02 and a negative $0.04 per share. For reference, analysts are expecting a loss of $0.01 per share on revenues of $142.4 million.

In FY25, BB has projected revenues between $586 million and $616 million while adjusted loss is forecasted to range from $0.03 to $0.07 per share. For reference, analysts have estimated a loss of $0.04 per share on revenues of $600.9 million.

Is BB Stock a Good Buy?

Analysts remain sidelined about BB stock, with a Hold consensus rating based on a unanimous three Holds. Year-to-date, BB has plunged by more than 25%, and the average BB price target of $3.07 implies an upside potential of 22.1% from current levels.