Shares of the UK-based Barclays PLC (GB:BARC) reached new heights today after the bank announced its Q3 results, beating analysts’ expectations. Barclays posted a £1.6 billion net profit attributable to shareholders, exceeding the £1.17 billion consensus forecast and rising 23% year-over-year. Additionally, revenue for the third quarter reached £6.5 billion, surpassing the £6.39 billion forecast. BARC stock rose nearly 4% as of writing, hitting its highest level since October 2015.

UK Banks Brace for Resilient Q3 Amid Rate Cuts

Banks in the UK and Europe have delivered strong profits in recent years, driven by higher net interest income. The Q3 results mark the first earnings for UK banks after the recent interest rate cut, prompting investors to closely monitor the effects on net interest income (NIM) and profit margins. Investors seek reassurance about banks’ long-term earnings potential as interest rates decline.

Yesterday, UK-based Lloyds (GB:LLOY) reported a statutory pretax profit of £1.8 billion in Q3, surpassing the analyst forecast of £1.6 billion. Lloyds reported a NIM of 2.94%, down from 3.15% the previous year. Consequently, underlying net interest income declined by 8% year-over-year to £9.6 billion.

Barclays Raises 2024 Income Outlook

For the full year, Barclays raised its net interest income forecast to exceed £11 billion instead of its earlier forecast of reaching that target. For 2026, the bank is targeting a total income of £30 billion.

In Q3 2024, Barclays reported a 5% jump in its group income of £6.5 billion compared to the same period a year ago. Among its segments, income from the Investment Bank division soared by 6% year-over-year, driven by increased deal activity.

Additionally, the bank’s return on tangible equity increased to 12.3% in Q3, up from 9.9% in the second quarter. While its CET1 (Common Equity Tier 1) ratio rose to 13.8%, compared to 13.6%. The CET1 ratio is a key measure of solvency for banks. For the full year, Barclays expects to maintain its CET1 ratio within the target range of 13-14%.

Is Barclays a Good Share to Buy?

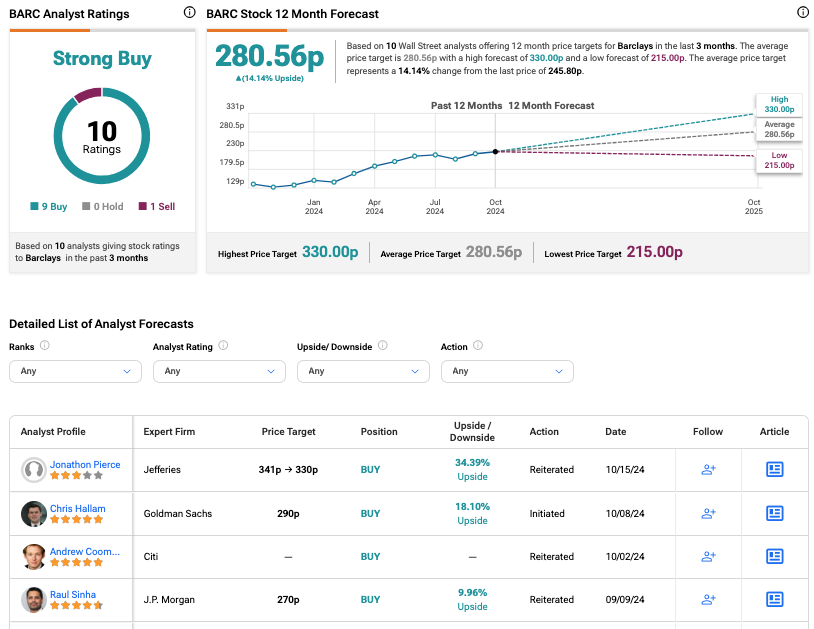

On TipRanks, BARC stock has received a Strong Buy rating, backed by nine Buy and one Sell recommendations. The Barclays share price forecast is 280.56p, which is 14.14% higher than the current trading level.