Today, you’re invited to think outside of the box and look outside of the U.S. for a true bargain. In the field of generative AI (gen-AI) tech, Baidu (NASDAQ:BIDU) is a standout that you might not have considered yet. All in all, I am bullish on BIDU stock and view it as a prime pick for value seekers everywhere.

Baidu is basically China’s counterpart to America’s Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG). Just as Alphabet’s Google is the dominant search engine in the U.S., Baidu has a firm foothold in China’s search engine market.

Yet, there’s more to Baidu’s story than the company’s search engine. The financial market doesn’t seem to have assigned the full value to Baidu’s other business ventures, which prove to be substantial revenue generators for Baidu.

Triumph and Trouble

July isn’t even halfway over yet, but there’s been a flurry of activity in the area of autonomous (self-driving) vehicles. Baidu is caught up in the mix of notable news items, which involve triumphs but also a troubling incident for Baidu.

Here’s the scoop. On July 1, Beijing (the seat of China’s government) effectively gave the green light for driverless cars to hit the roadways in China’s capital. More precisely, the Beijing Municipal Bureau of Economy proposed regulations that would “promote and regulate the innovative activities of self-driving cars, the development of the industry and the construction of intelligent transport.”

It’s only a proposed set of regulations, but I have a funny feeling that whatever Beijing wants, Beijing will probably get. Thus, it might not be very long before Baidu can freely put fully self-driving vehicles on the streets of Beijing.

Then, on July 8, The Wall Street Journal reported that China’s government officially permitted the “use of driverless robotaxis in which no safety supervisors are present” in Shanghai, China’s Pudong district. Again, this is a win for Baidu’s self-driving vehicle venture.

Bocom International analyst Angus Chan acknowledged that it “may still take longer to see large-scale commercialization of robotaxis in China.” Still, Baidu can count this development as a small victory, as “approval [from major cities] is an important step in granting these companies access to test their technology and access road data.”

However, trouble would soon strike. According to an Associated Press report from July 9, a Baidu-operated “driverless ride-hailing car” (i.e., a robotaxi) “in China hit a pedestrian.” This might sound like a terrible public-relations incident for Baidu, but believe it or not, Baidu stock rallied 8.47% yesterday.

As it turned out, the pedestrian was reportedly not seriously injured. Furthermore, the pedestrian “was reportedly crossing against the light.” It’s possible, then, that investors were relieved to learn that Baidu probably wasn’t at fault for this unfortunate incident.

Baidu Stock Is Ridiculously Cheap

There’s another possible reason why BIDU stock jumped on July 9, however. I suspect that the market is finally letting beaten-down technology stocks out of the doghouse as bargain hunters look far and wide for great values.

In other words, Baidu stock is cheap and overdue for a big bounce. As you may recall, Baidu beat analysts’ first-quarter 2024 consensus revenue and earnings estimates. Granted, China’s economic post-Covid-19-pandemic recovery has been uneven sometimes, but Baidu seems to have navigated the country’s macroeconomic challenges fairly well.

Therefore, the beatdown of Baidu stock in 2024 seems irrational and overdone. As Barron’s implied, Baidu is a juggernaut in multiple technology fields. “Along with controlling most of China’s search business, Baidu is also a player in the AI space, operates self-driving taxis in Beijing and Wuhan, and has a chatbot called Ernie,” Barron’s explained.

You might not have heard of Ernie, but it’s certainly known in China. A generative AI chatbot that’s comparable to OpenAI’s ChatGPT, the Ernie Bot has garnered over 300 million users.

So, don’t be surprised if BIDU stock jumps for what seems like “no apparent reason.” There actually is a reason: Baidu is undervalued and deserves a re-rating among investors. On a GAAP-measured, trailing 12-month basis, assuming a share price of around $98, Baidu’s price-to-earnings (P/E) ratio is 8.4x. That’s substantially lower than the sector median P/E ratio of 18.23x, and this should be music to any bargain hunter’s ears.

Is Baidu Stock a Buy, According to Analysts?

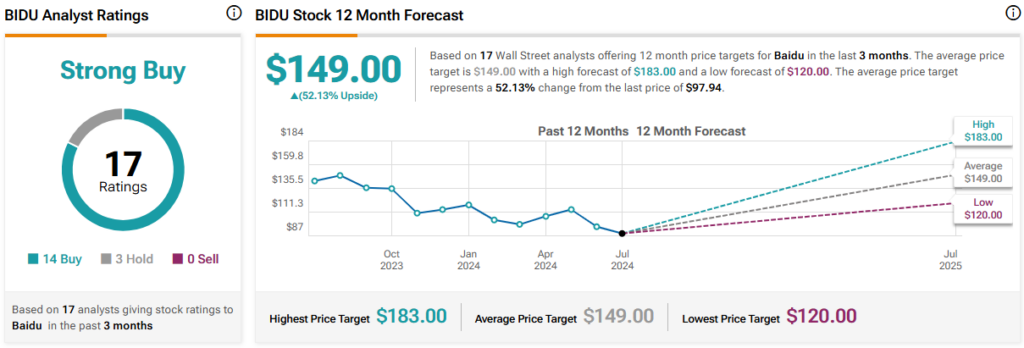

On TipRanks, BIDU comes in as a Strong Buy based on 14 Buys and three Hold ratings assigned by analysts in the past three months. The average Baidu stock price target is $149.00, implying 52.1% upside potential.

Conclusion: Should You Consider Baidu Stock?

So far this year, the market hasn’t fully appreciated the value of Baidu’s various business ventures. Beyond Baidu’s search engine, the company could generate ongoing revenue from the Ernie chatbot as well as from robotaxis.

Hence, if and when the Baidu share price suddenly recovers to the upside, it shouldn’t come as a complete surprise. In the final analysis, I currently view BIDU stock as this year’s number-one gen-AI technology bargain and would absolutely consider buying it now.