Uber (UBER) could face a peculiar problem in New York City as some of its vehicles in NY could soon be left without insurance. This is because the American Transit Insurance Company (ATIC), a key player in New York City’s commercial car insurance market, is currently facing insolvency.

Overview of ATIC

ATIC is the primary insurer for around 60% of the city’s 117,000 taxis, livery cabs, black cars, and rideshare vehicles, including those driving for Uber. However, if ATIC fails, many taxi and rideshare drivers could be left without insurance, creating a significant shortage of available vehicles.

ATIC is facing potential bankruptcy after posting over $700 million in net losses in the second quarter, a situation Bloomberg reports has “few precedents” in the insurance industry.

Why Could a Bankrupt ATIC Be a Problem?

If ATIC goes bankrupt, the remaining insurers would likely struggle to handle the increased demand, potentially causing premiums for taxi and limo drivers to skyrocket. According to Bloomberg, ATIC has underpriced insurance for decades, raising concerns about whether its premiums are sufficient to cover claims. In the insurance industry, underpricing means offering premiums too low to avoid financial losses, leaving the company unable to cover claims.

Uber’s Lawsuit Against ATIC

In fact, earlier this year, Uber took legal action against ATIC, filing a lawsuit in federal court. Uber accused ATIC of consistently failing to follow reasonable claims-handling practices and neglecting to resolve claims fairly. This alleged negligence led to 23 lawsuits filed against Uber and its drivers, stemming from crashes involving bodily injuries. This forced the rideshare giant to pay substantial amounts in legal defense costs.

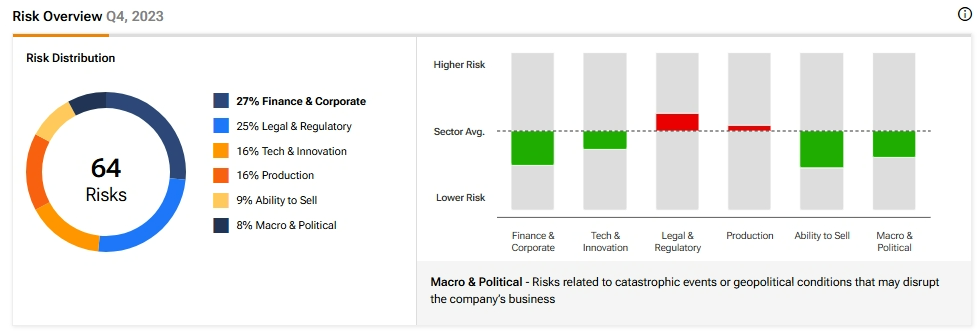

This kind of legal and regulatory risk is the second most significant risk for Uber. In fact, according to the TipRanks Risk Analysis, Uber is at a higher legal and regulatory risk of 25%, compared to the sector average of 20.3%.

What Is the Future of Uber Stock?

Analysts remain bullish about UBER stock, with a Strong Buy consensus rating based on 31 Buys and one Hold. Over the past year, UBER has increased by more than 50%, and the average UBER price target of $87.93 implies an upside potential of 22.3% from current levels.