The stock of AST SpaceMobile (ASTS) is down 12% after the satellite designer reported a loss for this year’s third quarter that was worse than Wall Street had expected.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

The company announced a loss of -$1.10 per share, which was much worse than a loss of -$0.20 that was the consensus forecast among analysts. The Q3 loss at AST SpaceMobile was also much worse than the loss of -$0.23 a share that the company reported a year earlier.

AST SpaceMobile also announced revenue for the three months ended September 30 of $1.1 million. That was slightly better than the $1 million of sales that analysts had penciled in for the company. A year ago, the company had no revenue.

Available Cash

Based in Texas, AST SpaceMobile is building a constellation of space-based cellular broadband satellites that will provide smartphones with internet connection in underserved areas and areas with coverage gaps. The company said it had $518.9 million of cash on hand at the end of the third quarter.

AST SpaceMobile said in its earnings statement that it has secured agreements to provide space-based cellular broadband internet service coverage to key markets in the U.S., Europe, and Japan, and hopes to launch satellites into space in both 2025 and 2026.

ASTS stock has risen 344% so far this year.

Is ASTS Stock a Buy?

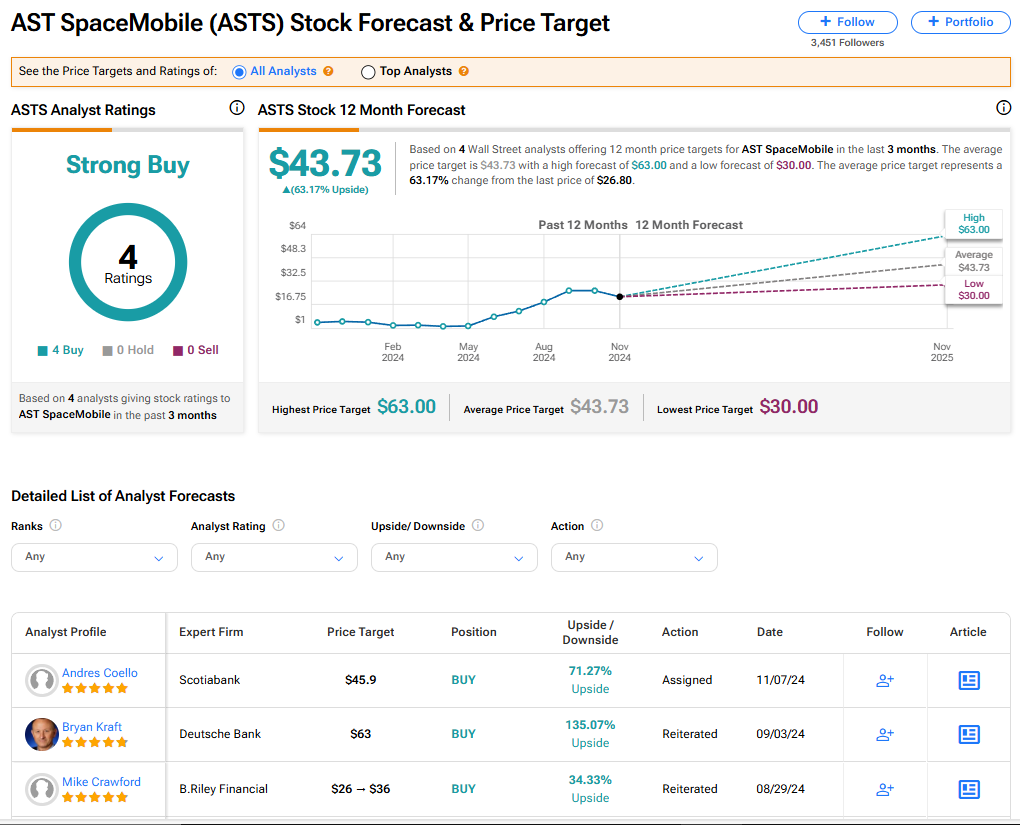

The stock of AST SpaceMobile has a consensus Strong Buy rating among four Wall Street analysts. That rating is based on four Buy recommendations issued in the last three months. There are no Hold or Sell ratings on the stock. The average ASTS price target of $43.73 implies 63.17% upside from current levels.