Shares of FTSE 250-listed Ashmore Group (GB:ASHM) soared nearly 7% as of writing after the company reported asset growth in its Q1 trading update. As of September 30, the total AUM (assets under management) reached $51.8 billion, reflecting a 5% increase compared to the previous quarter. Assets under management rose by $2.5 billion during the quarter.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Ashmore Group is an investment management firm that focuses on equities and various asset classes within emerging markets.

Ashmore’s Update Highlights a Favourable Shift

Ashmore’s favourable update marked a reversal of years-long underperformance for the company. Over the last few years, the company has faced challenges in emerging markets due to a struggling Chinese economy and the negative impact of the Russian invasion of Ukraine on sentiment in Eastern European markets.

Reversing that, it reported a positive investment performance of $3.2 billion in the first quarter of FY25. Additionally, the net outflows for the period declined to $0.7 billion from $2 billion in the previous quarter. Meanwhile, emerging markets posted solid returns over the quarter, with fixed-income indices climbing between 4% and 9%, while equities rose 8%. The numbers indicate a rising interest in emerging market investments.

Among its asset classes, fixed-income AUM increased 5% to $43.3 billion, while equity market AUM grew 9%. On the other hand, alternative AUM declined 8%.

The company credited its improved performance to a weakening US dollar, better macroeconomic conditions, and China’s fiscal stimulus plans. Moving forward, the company expects investments in emerging markets to further grow across equity and fixed-income asset classes.

Is Ashmore Group a Good Buy?

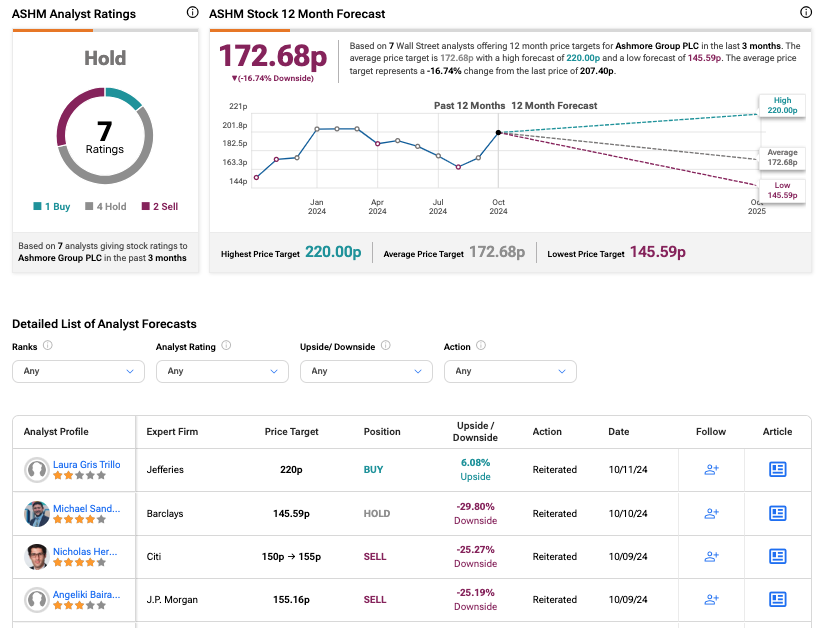

On TipRanks, ASHM stock has received a Hold rating backed by four Holds, two Sells, and one Buy recommendation. The Ashmore share price forecast is 172.68p, which is 17% lower than the current trading levels.