IT and professional services company ASGN Incorporated (ASGN) has acquired Avaap’s Infor business. The financial terms of the deal have been kept under wraps. Avaap is an advisory and technology management firm.

CEO of Avaap Dhiraj Shah said, “We are excited for the next evolution of Avaap, and the transaction represents continued execution of the strategic plan to deliver excellent value to our customers, investors, and individuals who build their career at Avaap”.

Post the buyout, Avaap Infor will become a part of ASGN’s Apex Systems division. With this acquisition, ASGN will be able to take advantage of Avaap’s stellar expertise in developing enterprise cloud applications for finance and human resources and serve its customers more efficiently. (See ASGN stock chart on TipRanks)

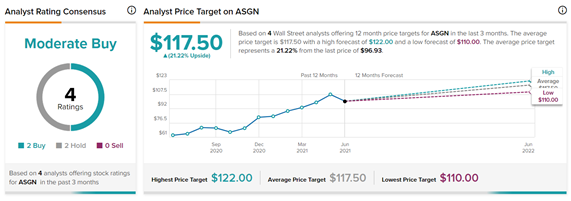

Recently, Truist Financial analyst Tobey Sommer reiterated a Buy rating on ASGN and raised the price target on the stock from $108 to $122, which implies upside potential of 25.9% from current levels.

According to Sommer, the company’s better-than-expected first-quarter results coupled with solid fundamentals makes it an attractive choice for investors. Furthermore, its foray into the lucrative IT consulting and defense/intel services can be drivers of growth for the company.

The stock has a Moderate Buy consensus rating based on 2 Buys and 2 Holds. The average ASGN price target of $117.50 implies 21.2% upside potential from current levels. Shares have gained 48.3% over the past year.

Related News:

Skillsoft Snaps Up Pluma for $22M

ExxonMobil Selling Santoprene Business for $1.15B

Bed Bath & Beyond Reports Better-Than-Expected Revenue, Misses Earnings; Shares Soar 11%