On the surface, the re-election of Donald Trump poses significant risks for Yum China (YUMC). As a fast-food operator commanding prominent brands like KFC and Pizza Hut in the lucrative Chinese market, YUMC stock would ordinarily be a compelling opportunity. However, Trump’s proposal for tariffs — combined with prior grievances against China’s leadership — has many economists and analysts worried.

Fortunately, there are some positive points that may help turn the tide in a more optimistic direction. First, while “The Donald” may be best known for his brash rhetoric, in reality, he’s much more sensible. Prior dealings with Beijing reveal that he’s willing to work through disagreements. Therefore, YUMC stock might not be in grave danger as previously believed.

Second, Yum China posted strong growth during its third-quarter earnings report. Specifically, total system sales jumped 4%. In addition, China has yet to provide direct economic stimulus, meaning that it still has this option available. Therefore, I’m going to take a risk here and label YUMC stock as a bullish buying opportunity.

Using Options to Extract the Most Out of YUMC Stock

Usually, being bullish simply equates to buying shares of a company. However, I’m not entirely sure where YUMC stock may head over the long run. Therefore, I’m hesitant to discuss the next common idea: buying long-term call options. Again, it’s very difficult to know where YUMC may end up several months from now.

However, as investors digest the broader implications of a Trump administration — and the realization that circumstances might not turn out as bad as previously feared — a short-term options trade could be very attractive. Specifically, adventurous investors may want to consider the benefits of a Bull Call spread, which involves simultaneously buying and selling a call option.

Why sell a call when you’re optimistic? Basically, you would use the credit received from selling a higher-strike call to partially offset the debit paid for a lower-strike long call. This action reduces the breakeven point but at the expense of capping the upside at the strike of the short call. Since we’re dealing with a short time frame, the capped reward arguably isn’t as big of a deal as it sounds.

Finding the Right Trade

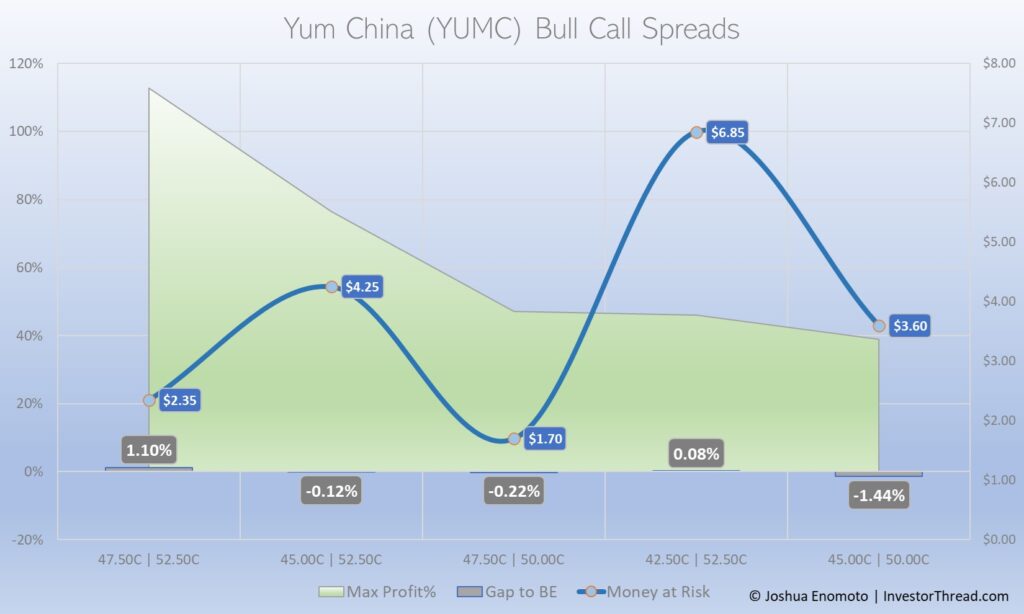

With a relatively popular stock like YUMC, investors will have several options trades to choose from. For Bull Call spreads that expire on Dec. 20, 2024, there are more than 20 strike-price combinations available. However, thanks to stochastic analysis, we can eliminate most of the available ideas and focus only on the most viable prospects.

Primarily, we must calculate the market’s expectation of price volatility. To figure this out, we take the product of three metrics: share price, implied volatility (IV) of the options chain, and the time decay adjustment (square root of the days to expiration divided by 365 days). Performing this exercise, we calculate the expected price volatility to be $5.48. Therefore, the market anticipates that YUMC stock will likely remain below $54.79.

In my opinion, the most sensible trade is the 47.50C/50C spread: you’d be buying the $47.50 call and selling the $50 call. The breakeven price sits at $49.20, slightly below today’s close of $49.23. This also means that you would be putting $170 at risk. However, if YUMC stock rises to $50 or higher, you can earn $80 or a payout of 47.06%. The same move with shares would earn only a 1.4% return.

Dialing Up the Risk-Reward Factor

One of the challenges of finding the most appropriate Bull Call spread is calculating the magnitude of the upside as accurately as possible. For example, if the target security rises well above the strike price of the short call, you’re leaving money on the table. In other words, you’re absorbing an opportunity cost.

We know from our stochastic analysis that the market anticipates the price to likely remain below $54.79 by the Dec. 20 expiration date. Therefore, we can potentially cheat up the short-call strike price to $52.50. Even if YUMC stock falls a bit short of the goal, it might still be able to hit $52.50. With that in mind, more daring investors may consider the 47.50C/52.50C spread.

This approach requires YUMC stock to reach $49.85 to be at breakeven. However, should the security reach the short call strike price, investors can earn $265. That’s a payout of 112.77% relative to the $235 at risk, as pictured in the image below. Of course, YUMC would need to jump 6.5% in a little over a month. Still, it’s not impossible, and there’s a massive reward for this act of speculation.

Wall Street’s Take on Yum China

Turning to Wall Street, YUMC stock has a Strong Buy consensus rating based on seven Buys, two Holds, and zero Sell ratings. The average YUMC price target is $49.17, implying 0.16% downside risk.

The Takeaway: Benefiting from YUMC Stock Options despite Trade Tensions

Yum China faces potential risks from Trump’s re-election due to his stance on tariffs and past conflicts with China, but the company’s strong growth in the Chinese market, along with potential economic support from the Chinese government, makes it a compelling opportunity.

A strategic Bull Call spread could allow investors to capitalize on short-term gains while managing risks. The 47.50C/50C spread offers a conservative approach, while a more daring 47.50C/52.50C spread could provide a higher payout if YUMC hits its target, allowing investors to navigate Trump-related uncertainties effectively.