Yum China Holdings (YUMC) had a dismal Q4 quarter due to China’s zero COVID policy, which resulted in reduced traffic and store closings.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Investors should look beyond the company’s pandemic woes to the company’s future, where Quo Vadis President John Zolidis sees an opportunity for a rebound in the company’s shares. As a result, I’m bullish on the company’s shares.

“Frankly, this is exactly the opportunity, as YUMC continues to build out its store network, make investments in infrastructure and enjoys the stability of a US$4B cash balance (no debt aside from leases) on its balance sheet,” he said, as estimates are coming down again and visibility on a positive inflection is low.

“However, at 8x EV/ 2023 EBITDA, we believe investors are paying very little for the growth option for this business, and it’s reasonable to believe in material multiple expansion when the zero-COVID policy is eventually relaxed or unwound, something we believe is inevitable,” he added.

Weak Performance

Zolidis’ comments come after the American-based restaurant chain in China reported lukewarm Q4 financial results due to the negative impact of COVID-19 outbreaks. Total revenues grew 1%. Full-year total revenues grew 19%, with an operating profit of $1.39 billion and adjusted operating profit of $766 million.

CEO Joey Wat was upbeat about the company’s future, thanks to several initiatives to revive the company’s brand.

“We continue to focus on offering good food, great value, and a seamless customer experience,” Wat said. “At KFC, new menu categories such as beef burgers and whole chicken have received great customer feedback and are now permanent items on the menu. With the strong brand positioning, KFC sets new records for its restaurant openings. Pizza Hut improved profitability and reaccelerated its store openings to the highest level since 2016. “

Wat was also upbeat about the company’s partnership with Lavazza and the opening of new stores.

“We continue to build our industry-leading membership program, which has grown 20% in the past year to over 360 million members,” Wat added. “With enhanced digital capabilities, digital sales exceeded $7 billion, or over 85% of Company sales. Moreover, we strengthened our market leadership with record openings of over 1,200 net new stores while maintaining healthy new store payback.”

Investing in China

The lingering of the COVID-19 pandemic isn’t YUMC’s only problem. Investing in China-related business has been out of favor these days, due to the tightening of business regulations and the escalation of the government’s criticism of private businesses.

Investors have steered away from YUMC’s shares, which have lost closed to a 9.7% of their value in the last 12 months.

A Promising Investment

In spite of the temporary setbacks, YUMC is in the right market with the right business model.

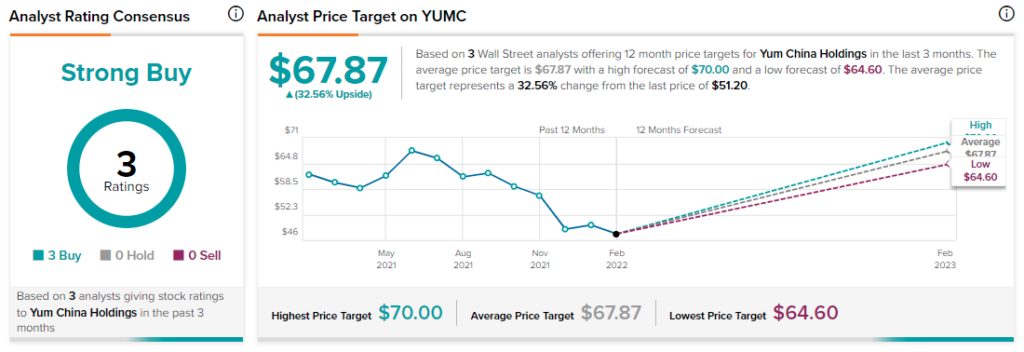

The three Wall Street analysts following the company’s shares in the previous three months see a limited upside potential over the next 12 months, with three Buy ratings.

The average YUMC price target represents 32.6% upside potential.

Summary and Conclusions

YUM China’s lackluster performance is temporary due to the lingering of the COVID-19 pandemic.

As a result, the company is well positioned to continue growing its presence in the world’s second-largest economy, rewarding long-term investors.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure