As tech valuations continue to climb, it may be time to take a step back to consider some of the names that may have been left (mostly) out of the latest AI-induced ascent. Indeed, not everything needs to be a direct beneficiary of AI to be a solid buy for the long haul. In this piece, we’ll look at three intriguing tech firms (WIX, GDDY, and RBRK) that have embraced AI but probably won’t be recognized as AI plays until a couple of years from now.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

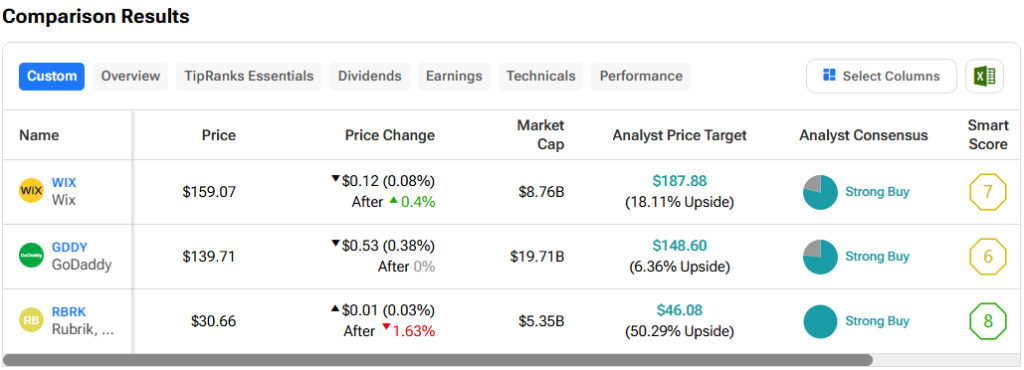

Indeed, each firm has been spending on AI efforts but in a more prudent fashion than some mega-cap tech titans that are more than willing to pour billions into AI with no assurances of return. With analysts recommending Strong Buys, let’s examine WIX, GDDY, and RBRK using TipRanks’ Comparison Tool to see which name holds the most potential.

Wix.com (NASDAQ:WIX)

Wix is an Israeli-based web development software firm that has picked up notable steam in recent years. Even after the latest 9% correction, shares of WIX are still up more than 130% in the past two years. That said, WIX stock is still off 55% from its early 2021 peak. As Wix continues innovating on AI tech tools, perhaps it’s not too long before investors recognize Wix as an AI-first company. Either way, the stock looks intriguing on the latest dip, and I’m staying bullish, even as the recovery trajectory gets a tad rockier.

In a recent gut punch, Piper Sandler analyst Clarke Jeffries (not to be confused by the investment firm Jefferies) downgraded WIX stock to Hold from Buy, primarily due to valuation concerns. Though Jeffries is encouraged by “AI-assisted design,” he thinks it’s too soon in the game to re-evaluate his growth expectations to the upside.

I don’t blame Jeffries for waiting to see how things play out with Wix and AI. However, AI is capable of moving faster than analysts can catch up with their price target hikes. AI will change web development as new tools make it easier to create the gorgeous digital storefronts of our dreams.

Of course, it will also take time before such new AI tools can be effectively monetized. But perhaps Wix’s new text-to-website conversational AI tool will beckon analyst upgrades sooner rather than later. Like with most impressive AI innovations, it’s a profound technology that will only improve with time.

What Is the Price Target of WIX Stock?

WIX stock is a Strong Buy, according to analysts, with 15 Buys and four Holds assigned in the past three months. The average WIX stock price target of $187.88 implies 18.1% upside potential.

GoDaddy (NASDAQ:GDDY)

GoDaddy is a top rival of Wix in the web development scene. Like Wix, it’s betting big on the power of generative AI. And it’s this AI prowess that’s helped GDDY stock pop like a coiled spring over the past eight months after going sideways for around five years. After nearly doubling (up 88%) in the past year, I think it’s time to give GDDY a second look as investors look for hidden AI potential. All things considered, I am bullish on GoDaddy.

Despite almost doubling in a year, the stock’s still dirt-cheap at 11.6 times trailing price-to-earnings (P/E), well below the infrastructure software industry average of over 41 times. Indeed, GoDaddy has a track record as a registrar, web host, and run-of-the-mill web builder. As the company’s Airo AI offering (which helps users get up and running quickly) advances, I think there’s runway for valuation multiple expansion.

Airo isn’t just an AI-powered website builder; it can automate various time-consuming tasks small businesses need to tackle to put themselves out there. Whether it’s Airo-assisted social media content generation or digital ad creation, Airo shows that it can save businesses time and money. Reportedly, GoDaddy sees generative AI tools saving small-business owners $4,000 and 300 work hours this year.

If Airo can be the AI product that helps deliver such savings, I do not doubt GoDaddy customers will be willing to pay for the toolset. Either way, GDDY’s P/E multiple doesn’t do Airo justice. Baird’s Vikram Kesavabhotla sees “more progress on Airo” as a potential catalyst for the stock in the second half of the year. He’s not wrong, in my view.

What Is the Price Target of GDDY Stock?

GDDY stock is a Strong Buy, according to analysts, with 10 Buys and three Holds assigned in the past three months. The average GDDY stock price target of $148.60 implies 6.4% upside potential.

Rubrik (NASDAQ:RBRK)

Rubrik is a data management and cybersecurity firm whose stock landed on the public markets back in April 2024. Undoubtedly, it’s been tough sledding since peaking in late April. Now down around 22%, investors may be wondering if the mid-cap ($5.5 billion) AI-leveraging cybersecurity firm is worth pursuing now that the stock’s hovering closer to its all-time lows of $28 and change per share. After a strong first-quarter showing, I’m inclined to be bullish, even if investors weren’t impressed.

With the company’s Ruby AI assistant, perhaps Rubrik is not only helping firms avoid breaches, but they may be reducing the impact of the blow should it happen. Indeed, it can cause quite a panic once a cyberattack does happen.

For many firms that never saw it coming, it can be tough to know what to do when time is of the essence. Undoubtedly, having an AI assistant like Ruby by one’s side provides peace of mind that money can buy when things get nasty after a cyber threat makes its mark. With Ruby, Rubrik stands out as an AI-first cybersecurity firm in an industry full of firms just getting aboard the AI train.

With strong demand for Rubrik’s software, I think it makes sense to give the name a look on the dip while it’s going for 7.7 times price-to-sales (P/S), which is not at all a high price to pay for a firm that grew its sales by 38% in the last quarter.

What Is the Price Target of RBRK Stock?

RBRK stock is a Strong Buy, according to analysts, with 13 unanimous Buys assigned in the past three months. The average RBRK stock price target of $46.08 implies 50.3% upside potential.

The Takeaway

These three AI innovators aren’t being fully respected by investors right now. Though their AI products could take many quarters (or even years) to reflect in current multiples, I do find that each name is more than deserving of a Strong Buy rating from the analyst community. Of the three, analysts see the most upside potential—a whopping 50.3%—in RBRK stock.