Micron Technology (MU), one of the biggest players in the rising semiconductor industry, has outperformed the overall market in recent months.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

From the looks of it, it is all set to continue its rally. The company is taking advantage of the high demand for memory, storage and advanced processors in the market.

It has gained more than 14% in the past six months. It had to undergo a steep sell-off like most other semiconductor stocks in the past month due to macro factors not having much relevance to the semiconductor industry.

The market, and us, are optimistic about the stock’s performance considering the immense future growth prospects it has, and the attractive price-to-earnings (P/E) ratio at which it is currently trading. We’re bullish on the stock.

Micron Technology is an American conglomerate that produces computer memory and computer data storage systems including dynamic random-access memory, flash memory, and USB flash drives.

The company operates through multiple segments such as the Compute & Networking Business Unit (CNBU), the Mobile Business Unit (MBU), the Storage Business Unit (SBU), and the Embedded Business Unit (EBU). Moreover, it markets its products under the brands Crucial and Ballistix.

The semiconductor industry is moving towards finding itself on the list of future winners. The pandemic-led production shutdowns created a huge shortage of these chips.

Chip demand is so huge as they are needed in every industry, from doorbells to Quantum computers.

Micron is one of the top players in this industry, and is in a very good position to reap the benefits out of this high-demand situation.

Joseph Moore, a Wall Street Analyst from Morgan Stanley also has an optimistic approach towards Micron Stock and has maintained a Hold rating on it. Moreover, he has also raised the price target on the stock to $77 from $75.

Strong Financials

Micron Technology has been delivering substantial growth, especially in the past two years. The company’s Q1 2022 results crushed the market’s expectations by reporting a 33% year-over-year surge in revenues.

The company’s revenue for the quarter was $7.69 billion, translating to adjusted earnings per share of $2.16. The company attributes such an increase in its earnings to the impressive performance of its mobile business.

Moreover, profitability has also improved within the company and its gross margin have shown a more than 16% improvement.

Micron’s guidance for the current year has also pleased the market. Its projected revenue for the next quarter is expected to be somewhere between $7.3 billion and $7.7 billion, and earnings per share might come around $1.85 and $2.05. Some might feel this represents a declining trend, but in actuality, the fiscal second quarter is normally lower seasonally.

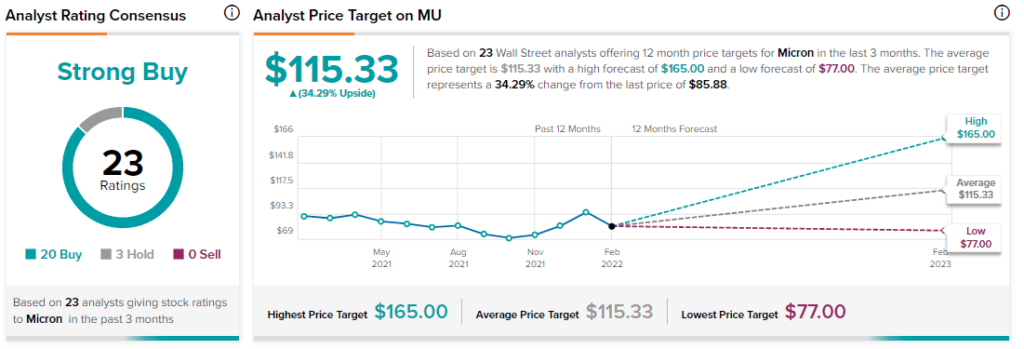

Micron holds a Strong Buy consensus rating on TipRanks, due to 20 Buys and three Holds.

The average Micron price target is $114.86 which is a healthy 34.3% upside on the stock.

5G Smartphone Tailwind

To date, the 5G-enabled smartphones have rapidly taken over the market. While back in 2019, these smartphones accounted for only 1% of the total smartphone shipments worldwide, by 2020 its share in the market went up to a whopping 20%.

By 2023, these shipments are expected to go up to as much as 69%.

Smartphones these days tend to use more DRAM (dynamic random-access memory) and NAND (short for “not and”) flash memory, and in the case of 5G smartphones, the requirement of DRAM is 50% higher compared to the usual 4G devices.

The amount of flash storage in 5G smartphones is also almost double than the 4G counterparts. This means there is a huge market opportunity in this segment for Micron.

Metaverse Opportunity

The world is moving towards a metaverse gradually, and Micron Technology is currently one of the cheapest metaverse stocks that can be found.

The company has already been riding on the advantage of the booming demand for memory chips used in several applications and the metaverse is going to fuel the demand for memory chips further. This is because data centers that handle metaverse works need higher amounts of DRAM to boost their computing powers.

Micron Technology has got tremendous potential and analysts expect its growth to pick up pace within the next couple of years. Over the years the company has developed a “multi-quarter” lead in leading-edge process technology both across the DRAM and NAND flash segments.

Moreover, at present, there are no such technology headwinds against the company but it has indeed got several tailwinds.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure