I am bullish on Walmart (NYSE:WMT) based on its roadmap to higher profitability in the coming years, along with its automation and other strategic efforts. I believe that once the macro sentiment recovers, the stock will be on an upward trajectory for years to come.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

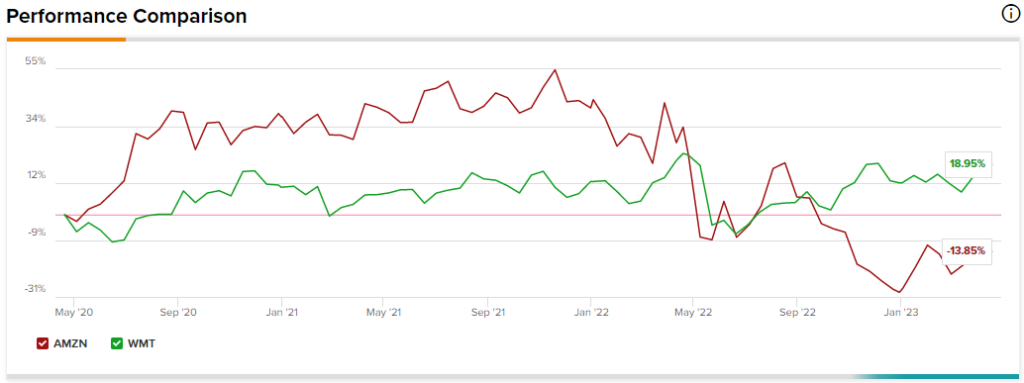

While in-store revenues still reflect the lion’s share of Walmart’s revenues, its e-commerce revenues have been soaring over the past years (17% growth in Fiscal 2023). Interestingly, in the past five years, WMT stock has gained 90% while its e-commerce rival Amazon (NASDAQ:AMZN) has returned only 35% over the same period. Likewise, in the last three years, Walmart returned 19% to investors, while Amazon lost 14% over the same period, as shown below.

Now, let’s take a look at what the future beholds for Walmart.

Automation to Act as a Long-Term Catalyst

Earlier this month, Walmart hosted its 2023 Investment Community meeting that left investors bullish at the end of it. The retail behemoth outlined its strategy for the next few years. Walmart plans to boost its operations and e-commerce platform by making meaningful technological investments, especially in the supply chain as well as its automation initiatives.

Giving out further details, Walmart expects 65% of its stores and 55% of its fulfillment centers to be serviced by automation by the end of FY2026. Moreover, automation efforts are expected to improve unit cost averages by ~20%, thereby leading to margin expansion.

Growing Digital Advertising Revenues Boosted by E-Commerce Optimization

Walmart’s relatively newer Global Advertising segment — led by Walmart Connect — is increasingly catching investors’ attention. The segment grew by 30% in Fiscal 2023 to $2.7 billion, while Walmart Connect registered a growth rate of 41% in Q4 2023. And the best part is that the revenues are automatically stimulated by growing traffic for Walmart’s e-commerce website.

Digging deeper, Walmart continues to bolster its e-commerce business. It has revamped its website by adding attractive features and deals. Moreover, greater optimization of its online website will directly boost its website traffic, thereby driving its online advertising business further. E-commerce optimization is a win-win for both its e-commerce and advertising businesses.

Walmart’s management is bullish on the growth prospects of the ad business going forward and expects it to represent a much higher percentage of revenues and profits in the coming years. Currently, the segment is reporting margins as high as 70% to 80% (versus low single-digit margins in its retail business), and this could be a key catalyst to boost earnings in the coming years.

The digital advertising space is clearly growing, and major retailers like Walmart and Amazon are making the most of that growth potential. For instance, Amazon reported $11.6 billion in advertising revenues in Q4 2022, which grew 19% year-over-year. Likewise, as Walmart increases its focus on the digital ad business, it could see much more growth.

Other Strategic Updates

At its two-day Investment Community meeting, the company reiterated its Q1 and FY2024 earnings guidance. For Q1, adjusted earnings are expected to range between $1.25 to $1.30 per share, driven by net sales growth of 4%-4.5% on a constant-currency basis. For the full year, adjusted earnings are expected to range between $5.90 – $6.05 per share with net sales growth of 2.5%-3% (constant currency). Given the current macro scenario, this was a positive, and it boosted investors’ confidence.

In addition, Walmart plans to create its own electric vehicle (EV) fast-charging network by adding them at the thousands of Walmart and Sam’s Club locations in the U.S. by 2030. This will be on top of the 1,300 EV stations it already operates at over 280 locations across the U.S., and it will create significant cross-selling revenue opportunities at Walmart stores.

Separately, joining the list of giant companies announcing layoffs, Walmart recently slashed 2,000 jobs soon after announcing the layoff of hundreds of its employees at five fulfillment centers last month, citing an uncertain economic outlook, inflationary pressures, and surging interest rates. In addition, Walmart also announced the closing of 19 stores across the U.S., as they were underperforming.

Is WMT Stock a Buy, According to Analysts?

As per TipRanks, the Wall Street community is clearly optimistic about Walmart stock. Overall, the stock commands a Strong Buy consensus rating based on 25 Buys and five Holds. Further, the average WMT stock price target of implies 10.2% upside potential from current levels.

Conclusion: Consider WMT Stock for the Long Term

Walmart’s Investment Community meeting gave out a strong positive signal to the investor community. Its plans to heavily invest in technology and automation could be the game-changer in the coming years, resulting in lower costs, higher efficiency, and margin upside that will make it more competitive versus its peers.

In the short term, Walmart stock may not be a clear outperformer due to inflationary headwinds. Longer term, however, the stock is poised for significant growth based on growing revenues and margins from its various strategic initiatives, including automation. This reaffirms my bullish stance on the stock.