On the surface level, a second round of the Trump administration might not appear to bode well for aerospace and defense giant Lockheed Martin (LMT). The former president and current Republican candidate for the White House made some comments that implied the U.S. would enter an isolationist stance (focusing on U.S. interests and reducing international involvement). However, this could actually lead America’s worried allies to increase their military budgets to compensate. Otherwise, the consequences could be devastating. Thus, I am ultimately bullish on LMT stock.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Shifting Geopolitical Grounds May Boost LMT Stock Financials

Recently, Trump told Bloomberg Businessweek that Taiwan should pay the U.S. for its defense. Some of the friction appears to be centered on the island’s economic success, particularly in the semiconductor realm. Indeed, the former real estate mogul and reality television star declared that it took “about 100%” of the U.S. semiconductor business.

To be fair, Trump has made some outlandish remarks in the past. Therefore, it’s difficult to know when the jesting ends and the truth begins. However, what is known is that the former president prefers a generally isolationist policy, even if it means sacrificing accountability. For example, Trump has made friendly overtures to North Korea’s Kim Jong Un. He’s done the same for Russia and China.

This sets the stage for an unusual backdrop for LMT stock. Right now, shares trade hands at 1.79x trailing-year sales. Currently, the price-to-sales ratio of the aerospace and defense industry comes in at 1.8x. Therefore, Lockheed is slightly undervalued.

As for trailing earnings, the market prices LMT stock at 18.36x. This metric sits much lower than the industry average 29.13x. However, there’s a caveat to this particular figure.

By the end of the current fiscal year, analysts believe that earnings per share may land at $26.26. That would come out to a decline of 5.71% from last year’s print of $27.85. Further, investors may have to wait until the end of Fiscal 2025 for the consensus EPS to improve to $27.96. That’s not exactly encouraging.

The top line presents a better-looking profile. Covering experts are hoping for revenue to hit $69.82 billion, up 3.3% from 2023’s haul of $67.57 billion. By the following year, sales may improve to $72.4 billion, up 3.7% from projected 2024 revenue.

Assuming that the share count of 237.94 million remains the same, LMT stock would be trading at 1.62x projected 2024 sales and 1.56x projected 2025 sales. Moreover, Lockheed just posted second-quarter earnings that significantly exceeded Wall Street estimates. So, it’s possible that analysts need to rethink their projections in favor of the bulls.

Nevertheless, even without the blowout earnings, if Trump wins a second term and takes an isolationist stance, this framework will likely favor Lockheed Martin. In other words, Lockheed is winning in a pre-Trump paradigm. A post-Trump victory may benefit LMT stock all the more.

Essentially, America’s European and Asian partners would have every reason to assume the worst; that is, the U.S. would turn a blind eye to Russian, Chinese, or perhaps even North Korean aggression. Almost certainly, that’s a terrible outlook for geopolitical stability. However, it may be a massive win for LMT stock.

Lockheed Martin Benefits from a Sense of Urgency

Of course, the acute nature of the proposed bullish case for LMT stock depends on a Trump victory. However, if the Democratic candidate wins (following President Biden’s stepping down), Lockheed would still be relevant. Neither Democrats nor Republicans have indicated any serious interest in cutting U.S. defense spending.

However, America’s international partners would be able to breathe a sigh of relief if the left wins. The pressing urgency to rearm based on the world’s lone superpower adopting an incoherent foreign policy would simply not exist.

So, how likely is it that former President Trump will win his second term? To be fair, polls need to be taken with a grain of salt, especially those conducted before September. For example, two years ago, pollsters predicted that a red wave would overwhelm the midterm elections. Experts anticipated a roaring lion; the American people received a screeching house cat.

Still, it’s more than fair to say that Trump and the Republicans have momentum on their side. President Biden simply did not perform well during the first debate. Naturally, the poor showing led many prominent Democrats to urge the president to step aside. And that has happened. However, now the left has an even more difficult task — finding an adequate ticket in a very limited time period.

Trump only has to focus on winning over the American electorate, which makes his job objectively easier at this point. So, the money is on “The Donald” to win a second term. In so doing, the world may see the U.S. shirk its traditional counterweight responsibility amid the rise of the new axis powers: China, Russia, Iran, and North Korea.

Sure enough, the prospect of a second Trump term has sparked discourse about the pressing geopolitical situation. In Taiwan, concerns have been heightened about Trump’s impact on the world stage, with many calling for increased defense spending. Broadly speaking, that should help LMT stock or, at the very least, put Lockheed in the discussion of an apparent global renaissance of security-focused expenditures.

Similar to the Democrats and their need for internal organization along with competing for the electorate, America’s global partners face a two-front battle: the new axis powers rising in conjunction with an isolationist U.S. policy. Again, that’s bad for geopolitical stability but great news for LMT stock as the urgency to arm up will skyrocket.

As recent news out of Taiwan demonstrates, U.S. partners are reading between the lines.

Is Lockheed Martin Stock a Buy, According to Analysts?

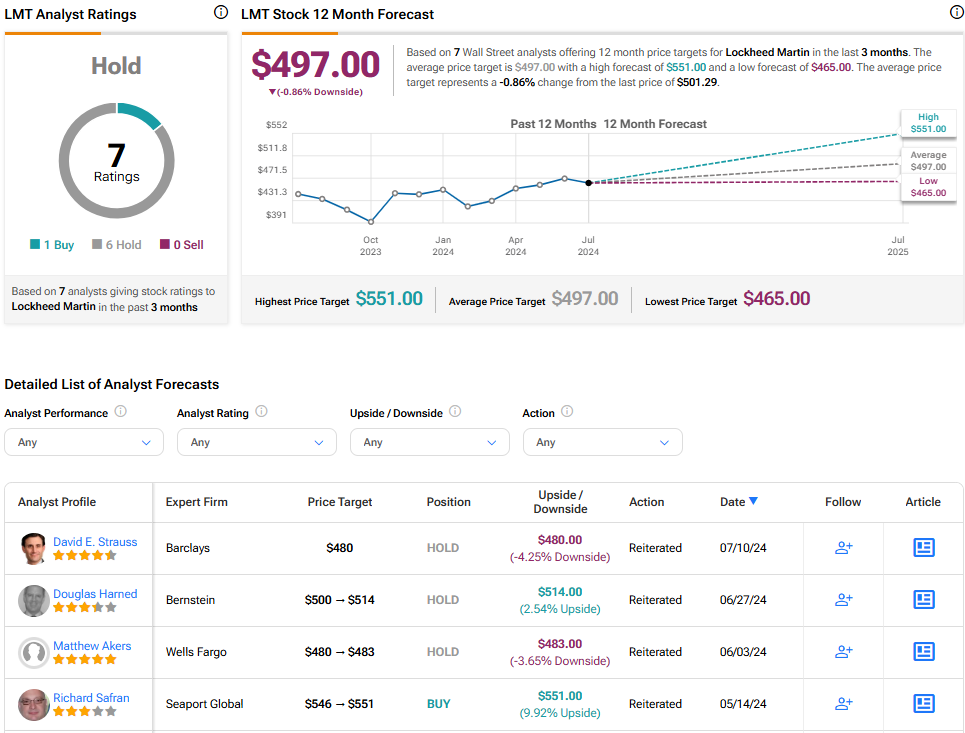

Turning to Wall Street, LMT stock has a Hold consensus rating based on one Buy, six Holds, and zero Sell ratings. The average LMT stock price target is $497.00, implying 0.86% downside risk.

The Takeaway: Shifting Geopolitical Tides Bode Well for LMT Stock

America and its allies are entering a dangerous and unprecedented time. Ahead of the rise of the new axis powers, the traditional approach would have seen the U.S. rise to meet the challenge. Instead, a second Trump administration may see the U.S. avoiding conflict, even at the expense of acquiescence. Naturally, this framework has many nations worried, which might serve Lockheed Martin well. After all, a sense of urgency has entered the geopolitical arena, which may boost LMT stock.