A lot is happening at Knights Group Holdings PLC (GB: KGH), which is igniting investors’ interest.

Don't Miss our Black Friday Offers:

- Unlock your investing potential with TipRanks Premium - Now At 40% OFF!

- Make smarter investments with weekly expert stock picks from the Smart Investor Newsletter

Based in the U.K., Knights Group Holdings provides legal, professional, and business services in the areas of banking, commercial, corporate, data protection, debt recovery, dispute resolution, and housing and regeneration. It has a current market capitalization of £116 million.

The stock has been highly volatile over the last twelve months, trading from the lows of GBp91.20 recently to highs of GBp455 in June last year.

Strikingly, following the trading update issued by the company, the share price saw a steep fall on March 22, losing half of its market capitalization in a single day. In fact, the shares are down 67% over the past six months.

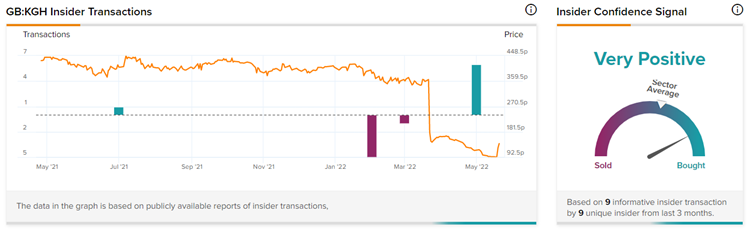

Now, however, the shares are back in green. Insiders at Knights Group Holdings are clearly optimistic about the stock’s near-term prospects and have bought stock for a whopping £1.2 million in less than a week.

Insider Buys Worth £1.2M within a Week

Last week, on May 19, a number of executives from top management bought shares of Knights Group Holdings in a series of Insider Buys.

Yesterday, Senior Officer and Director of Client Services, Mark Beech, bought 70,224 shares of Knights Group Holdings at GBp141.69 for a total value of £99,500.

On May 19, CEO David Andrew Beech was immensely positive on the stock with his informative buy. He acquired 936,345 shares of the KGH stock in a transaction wherein he spent £997,490 at GBp107 price levels.

With his latest Buys and current holding of 17.74 million shares worth £24.83 million, he now owns a whopping 20.99% or one-fifth of the total shares outstanding.

Furthermore, on the same day, CFO Kate Louise Lewis made an Informative Buy spending £39,900 to buy 38,643 shares at GBp103. Lewis now holds 104,990 shares worth £146,990.

Following in the footsteps of the CEO and CFO, two other Client Services Directors, Darren Walker and Lisa Shacklock, made Informative Buys on the stock.

Darren Walker bought 15,850 shares of Knights Group Holdings at GBp126 for a total value of £19,970, while Lisa Shacklock bought 41,655 shares at GBp120 for a total value of £49,990.

Now, let’s take a closer look at the recent events at the company that could have sparked the insider trading.

Reiterated Full-Year Outlook

On May 19, the legal and professional services firm provided a trading update for the full year ended April 30, 2022.

The company continues to forecast full-year revenues to grow 22% year-over-year to be approximately £125.5 million.

Further, underlying pretax profit will come in at a “minimum” of £18.1 million, lower than the £18.4 million reported for the prior-year period.

Shares gained over 30% following the news. Investors may have expected another bolt as seen on March 22, when the group downgraded its guidance, but were relieved to see the reiterated revenue guidance.

Concurrent with the update, the company also announced that its current COO, Richard King, will step down from his role to pursue other opportunities, effective May 31, 2022.

Knight Group is expected to provide further details on trading with its full-year results scheduled for July 2022.

Synergistic Acquisition of Coffin Mew for £11.5 million

Along with the reiterated guidance, the company also revealed its plans to acquire the leading U.K.-based independent law firm, Coffin Mew, from 12 existing equity partners for £11.5 million (approximately $14 million).

Based in the South East of England, Coffin Mew has a 130-year history. As of the year ended March 31 2022, Coffin Mew reported revenue of £11.3m.

Upon full integration and realization of all the expected synergies, the Board expects Coffin Mew to be immediately accretive to earnings and contribute an impressive PBT margin of 16%. The acquisition is expected to close in the month of July.

The addition of Coffin Mew will enable Knights to enter key new markets, including Portsmouth, Southampton, Brighton and Newbury. Further, the acquisition will significantly expand the group’s presence in the South of England, an attractive growth market for legal and professional services.

CEO Weighs In

Knights CEO David Beech sounded optimistic based on the positive trading momentum seen in the current year.

He stated, “There is a good pipeline of acquisition opportunities and the Group continues to selectively review a growing number of potential targets, focusing on firms of quality, with a strong cultural fit and which provide entry to new markets, or bolt-on opportunities to existing offices.”

Wall Street’s Take

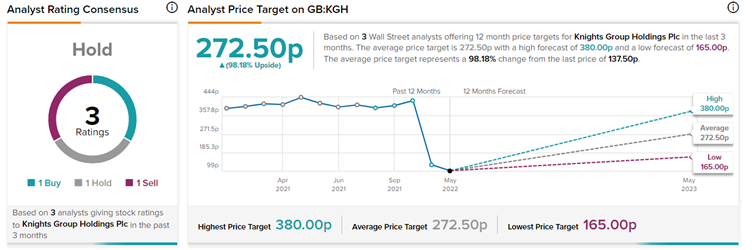

According to TipRanks’ analyst rating consensus, Knights Group Holdings is a Hold, based on one Buy, one Hold and one Sell. The average Knights Group Holdings price target is Gbp272.50, implying a strong 98.18% upside potential.

Concluding Thoughts

Knights has a clear-cut and robust growth strategy in place, with organic growth coming in by attracting senior fee-earners and inorganically through acquisitions of other regional law companies.

Given the robust pipeline of acquisition opportunities of quality independent law firms like Coffin Mew, the company may further enhance its growth potential by becoming one of the leading independent law firms in the UK.

CEO David Andrew Beech is clearly bullish on the stock with his gigantic Buys last week. He believes that the acquisitions made last year have integrated well and the ones to be made in the future will accelerate Knights’ growth in its key markets.

Other key executives followed suit, buying a large number of shares. It remains to be seen whether the investors tread the same pathway.

Discover new investment ideas with data you can trust.

Read full Disclaimer & Disclosure