This year’s low-risk appetite has resulted in a poor performance for American Well Corp. (AMWL), also known as Amwell, with shares scoring a bit worse than minus 12% since the start of the year. I am neutral on this stock for the time being, as the downtrend may not be over yet.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

A Large Telehealth Provider in the World’s Biggest Market

American Well stands out as one of the largest telehealth companies in the United States. That’s not trivial, given that the North American nation boasts of being home to the world’s largest market share of the core of the telehealth business. This is telemedicine, and, according to analysts, the demand for telemedicine services and devices will increase significantly in the coming years.

The company’s balance sheet is also solid, and these few but important elements could be enough to prompt a Buy today for AMWL stock, which appears cheaper than before, given the year-to-date decline. However, there’s the not very reassuring aspect of current and future profitability that leads to nothing more than a wait-and-see attitude towards this stock right now.

Technology Adoption to Drive Telemedicine Demand Higher

The increasing adoption of diverse systems, including cell phones, satellites, the Internet, and various media services in the U.S., is promoting the expansion of telemedicine services to any desired location across the country, even at a significant distance from the point of origin.

According to IndustryARC market research, North America is estimated to hold the largest share of the global telemedicine market, accounting for more than 45% of the total. The report suggests that the rapid pace of technological innovations is expected to be a strong contributor to the demand for telemedicine services.

As an industry leader, American Well should be able to meet much of that future demand, which could significantly benefit its profitability.

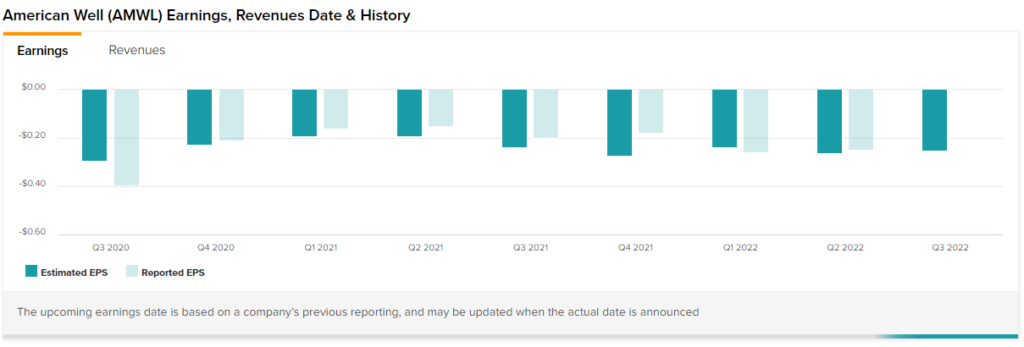

However, its net income is currently negative and should remain so throughout 2022.

Q2-2022 Results: Growing While Losing Money

Despite an improvement in active caregivers (46% year-over-year growth) and visits (19% year-over-year growth) driving revenue growth, the digital care support platform is still not making a profit.

Total revenue for the second quarter of 2022 was $64.5 million, up 7% year-over-year, beating the Wall Street consensus of $64.13 million.

However, the earnings were negative, as the adjusted EBITDA was a loss of $42.8 million, and the net loss per share of $0.25 worsened from a year ago when the net loss was $0.15.

The company is expected to be generating losses until the completion of its business transition, which consists of unifying its business offering of modules and programs to customers. With this strategy, the company wants to reach a larger customer base.

According to Dr. Ido Schoenberg, chairman and CEO of Amwell, the company is accelerating things to get out of this transition period as soon as possible.

Regarding its full-year 2022 financial outlook, American Well Corp expects Adjusted EBITDA to be between -$200 million and -$190 million despite higher year-over-year revenue of $275 million to $285 million. AMWL’s total revenue in 2021 was $252.8 million.

American Well’s Balance Sheet is Solid

As of June 30, 2022, American Well Corp had cash and marketable securities of $630 million, down from $675 million in the first quarter of 2022 and a drop from $746.4 million in the fourth quarter of 2021. AMWL’s total debt amounted to $16 million as of June 30, 2022.

From a financial strength perspective, however, the balance sheet appears solid, as indicated by an Altman Z-Score of 5.25, a measure of the likelihood of bankruptcy. That is, American Well Corp is not at risk of bankruptcy, as an Altman Z-Score above 2.9 indicates a safe zone. A ratio of less than 1.79 indicates a relatively high risk of bankruptcy, while any value in the 1.79 to 2.9 range still carries a risk of default, albeit small.

Is American Well a Good Stock to Buy?

In the past three months, three Wall Street analysts have issued a 12-month price target for AMWL. The stock has a Moderate Buy consensus rating based on one Buy and two Holds.

The average AMWL price target is $6, implying 13.2% upside potential.

AMWL Shares Can Still Go Lower

AMWL shares are changing hands at $5.30 as of this writing for a market cap of $1.45 billion and a price-sales ratio of 5.5x. Shares gained 7.5% after the release of second-quarter financial results on August 4, although the stock is trading below the median of its 52-week range of $2.52 to $11.40. Thus, the price for this stock is not high compared to its past, but it is not a bargain either. This is because additional net losses could potentially affect the stock.

Therefore, it is probably better to wait for a lower price before adding AMWL shares in order to get a better margin of safety.

The stock has a 14-day Relative Strength Index (RSI) score of 63, suggesting that the stock price is close to becoming overbought now. An interpretation of this indicator suggests that there may still be room for further setbacks.

The indicator ranges between 30 and 70. A value of around 30 means the stock is oversold, while a value of 70 means the stock has reached the overbought level.

Conclusion – An Interesting Stock, but Likely Not a Buy

American Well Corp is one of the largest telehealth companies in the American market, making it a leader in the industry. This is an interesting stock, but it doesn’t look like a Buy right now; it’s likely better to wait.

The outlook for the U.S. market is favorable, and demand for its core business, telemedicine services, is expected to increase. In this context, American Well is trying to better position itself through a transition aimed at attracting more customers to its services.

However, until the transition is complete, the company could report more negative results on top of its second-quarter 2022 results, which can negatively impact its share price.